January 25, 2024 •

Ask the Experts – Registration on State and Municipal Levels

Urupong - Getty Images Pro

Q: I need to lobby on the municipal level, but I’m registered with the state. Am I covered? A: It will depend on the state, but you might not be covered. Some states, including Georgia, Illinois, Missouri, and New York, […]

Q: I need to lobby on the municipal level, but I’m registered with the state. Am I covered?

A: It will depend on the state, but you might not be covered. Some states, including Georgia, Illinois, Missouri, and New York, to name just a few, have lobbying laws covering both state and local governments. If you are registered in such a state, however, that does not necessarily end the analysis.

Even in states where state lobbying laws apply locally, you may still have local obligations. New York state law requires registration if you lobby locally and otherwise meet the registration requirements, but New York City has its own registration regime you will be required to follow, potentially requiring registration at both the state and local level. Illinois lobbying law covers local governments as well, but includes a carve out for lobbying in Chicago. Lobbying in Chicago requires registration with the city, but not with the state.

Whether you are or are not in a state where the lobbying laws apply locally, you will need to verify whether the city or county you are contacting has its own lobbying law. Even if it does not, be aware there may be other requirements, such as visitor logs, with which you will still need to comply.

Finally, be aware some local agencies, particularly those covering large metro areas, have their own lobbying laws as well, so registration with the city or county still may not cover your contacts with those agencies. For instance, Broward County Public Schools and the Los Angeles Metropolitan Transportation Authority (LAMTA) have adopted lobbying provisions separate from those of the counties in which they are located.

It is safest to always assume your government outreach, regardless of the level of your interaction, is covered by a lobbying law until you confirm otherwise.

Further information about the lobbying laws in hundreds of cities, counties, and local agencies can be found in the Lobbying Compliance Laws section of the State and Federal Communications website.

November 13, 2023 •

Ask The Experts – House and Senate Post-Employment Restrictions

Q: We recently hired a lobbyist that is coming to our company directly from spending a number of years as a Senate staffer. What restrictions should we be aware of as her new employer in terms of who she can […]

Q: We recently hired a lobbyist that is coming to our company directly from spending a number of years as a Senate staffer. What restrictions should we be aware of as her new employer in terms of who she can contact on the Hill?

A: Both the House and the Senate have post-employment restrictions for certain individuals leaving their employment on the Hill.

Importantly, the House and Senate ethics committees will discuss with the staffer prior to their departure the restrictions under which they must operate. That said, as her new employer, you should definitely be aware of what restrictions are applicable to her situation so neither the company nor she violates the rules. For the Senate, senior staff, defined as individuals whose annual salary is $130,500 or more, are subject to a one year Senate-wide ban. Essentially, senior staff leaving the Senate may not lobby the entire Senate for one year following their departure – this includes lobbying contact with personal, committee, and leadership offices. Staff making less than $130,500 a year are subject to a one-year ban from lobbying their particular office – whether personal, committee, or leadership office. The House restriction for senior staff is a one-year ban from lobbying the particular office for which the former staffer worked and there is no ban in the House for staffers making less than $130,500.

For more information about post-government restrictions in both the federal legislative and executive branch, please contact us directly.

October 12, 2023 •

Ask The Experts – Updates to the Indiana Lobby Registration Commission (ILRC) Website

Indiana State Capitol - By Daniel Schwen / CC BY-SA

Q: I heard the Indiana Lobby Registration Commission (ILRC) updated their website. How will the changes affect how lobbyists register and file reports? A: Yes, the ILRC has upgraded their reporting system and new features have been added. Per the […]

Q: I heard the Indiana Lobby Registration Commission (ILRC) updated their website. How will the changes affect how lobbyists register and file reports?

A: Yes, the ILRC has upgraded their reporting system and new features have been added. Per the ILRC, the updates will be live as of September 2023.

For registrations, memorandums of understanding (MOU) will be filed from within the online filing system. Lobbyists will no longer need to email a digital copy and the MOU will be a part of the online filing process and accessible online. To add a new lobbyist, a lobbyist will be asked to enter the date of the lobbying agreement and the social security or tax identification number. The system will search and verify the lobbyist is not already in the system. If the lobbyist is not in the system, then it will proceed to create a new MOU. If the lobbyist is in the system, instructions will be given on how to proceed. To amend a current MOU, the lobbyist may select their name from a dropdown list and make the appropriate changes to the information.

All filings will now be submitted directly to the ILRC after being approved by either the lobbyist or by the responsible person. Previously, filers were required to do a final submission as the preparer of the report or registration after approval. Going forward, lobbyists will be notified when the filing is approved and submitted directly to the Commission. An audit process has been added to the filing system to ensure the accuracy of filings and the ILRC will reach out if a filing was declined due to an error or omission which must be corrected before it is accepted.

Other changes include upgrades to the system’s search function. As soon as a lobbyist opens their account the dashboard will now include pending filings, MOUs, and appeals. Additional search upgrades include being able to sort previous filings by year, type, status, and confirmation number.

The information from this response can easily be found on our website in the Lobbying Compliance section of the United States Compliance Laws publication. Please do not hesitate to contact us if you have questions.

September 12, 2023 •

Ask The Experts – New York’s New Ethics Training Requirements

NY State Capitol - by formulanone

Q: I heard New York has new ethics training requirements. What do I need to know to be compliant? A: That is correct. The New York State Commission on Ethics and Lobbying in Government (COELIG) has expanded the ethics training […]

Q: I heard New York has new ethics training requirements. What do I need to know to be compliant?

A: That is correct. The New York State Commission on Ethics and Lobbying in Government (COELIG) has expanded the ethics training requirements as part of the new Ethics Reform Act of 2022. All lobbyists (Principal, Individual, and In-House lobbyists), contractual clients, and beneficial clients listed on a submitted 2023-2024 Statement of Registration are required to take this new training in 2023 and certify completion of the training requirement on the Lobbying Application website. The training requirement is triggered by and applicable to those individuals and entities listed on a lobbyist or client Statement of Registration once the registration is submitted.

For the purposes of training compliance by organizations listed as a lobbyist or client, the Chief Administrative Officer of the organization is responsible for taking the training. Individuals associated with 2023-2024 registrations submitted on or before January 18, 2023, had an extended training due date of March 18, 2023. Those individuals associated with a 2023-2024 registration submitted after January 18, 2023, have 60 days from the registration submission date to complete and certify the training. Following completion of the initial training, individuals will be required to take a refresher training every three years.

Individuals may access the course through a hyperlink on the COELIG website or directly at https://lobbyingtraining.ethics.ny.gov/

July 19, 2023 •

Ask The Experts – Registering as a Lobbyist in Quebec

Quebec National Assembly - dszpiro

Q: I need to register as a lobbyist in Quebec for my company. What steps do we need to complete in the new system? A: The Lobbyist Registry in Quebec has been replaced by Carrefour Lobby Quebec. Previously, the senior […]

Q: I need to register as a lobbyist in Quebec for my company. What steps do we need to complete in the new system?

A: The Lobbyist Registry in Quebec has been replaced by Carrefour Lobby Quebec. Previously, the senior officer was responsible for creating an account, and would list any individual lobbyists or administrators on the company’s account. With the new system using Carrefour Lobby Quebec, the senior officer and each lobbyist must create an individual account, referred to as a professional space. A professional space can then be linked to an organization’s account, referred to as a collective space.

To create a personal space, you first need to create your account with Carrefour Lobby Quebec. After creating your account, you must verify it. You can use the Verified.Me platform, which requires you to login to your financial institution. This is the easiest method to use. In the alternative, you can use an ID verification form managed by Lobbyisme Quebec. With this option, you will be required to upload photo identification such a driver’s license along with a recent financial statement verifying your current address. Once authenticated, you will have access to your professional space.

The collective space for an organization can be opened by the senior officer, an employee, or even a third party. Once the collective space has been opened, all individuals with an authenticated professional space can request access to the collective space. The senior officer must approve or validate these requests. All mandates can then be published to the collective space by the senior officer, a lobbyist, or an administrator who has been granted access by the senior officer.

The information from this response can easily be found on our website in the Lobbying Compliance section of the Canada Compliance Laws publication. Please do not hesitate to contact us if you have questions.

June 13, 2023 •

Ask The Experts – Texas Sponsorship Laws

Q: My organization wants to sponsor a reception in Texas. State legislators, staff, and family members are likely to be in attendance. As a registered lobbyist, what are my limits and reporting obligations? As a registered lobbyist, there are several […]

Q: My organization wants to sponsor a reception in Texas. State legislators, staff, and family members are likely to be in attendance. As a registered lobbyist, what are my limits and reporting obligations?

As a registered lobbyist, there are several items to keep in mind when sponsoring an event. First, a lobbyist can provide an unlimited amount of food and beverage to an official, employee, immediate family member, or guest when the lobbyist attends the event. If not present at the event, food and beverage expenditures are limited to $100 or less.

Next, when engaging with officials at the event, sponsorship is considered a lobbying expenditure and will need to be disclosed on the appropriate lobbying report. These reports break expenditures down by type (food and beverage, entertainment, transportation, etc.) and by recipient. This may seem straightforward, but if your sponsorship goes to the organizing entity, how do you know how your dollars are being used?

The state provides some guidance here. When reporting expenditures for a reception or banquet type event, the Food and Beverage category includes all items needed to hold the event such as room rental, table settings, and printing costs. Other categories may need to be included depending on the specific event.

Additionally, you will need to know who among the attendees are in a reportable category of persons benefitted. Generally, this is state senators/representatives, state officers, state employees, immediate family members, and guests. If a combination of these groups are in attendance, or a combination of covered and non-covered individuals, the expenditure should be divided appropriately based on the numbers in each category. If all members of the legislature are invited, the entire expenditure is reported under that category. As long as all members are invited, it does not matter how many actually attend.

Finally, keep in mind the detailed reporting threshold. If the per person costs exceed the threshold, currently $132.60, the individuals must be identified and other details disclosed.

For more information, please see the “Reports Required” and “Gift Law” sections of the Lobbying Compliance Laws online publication for Texas. If you have any questions, please feel free to contact us.

April 26, 2023 •

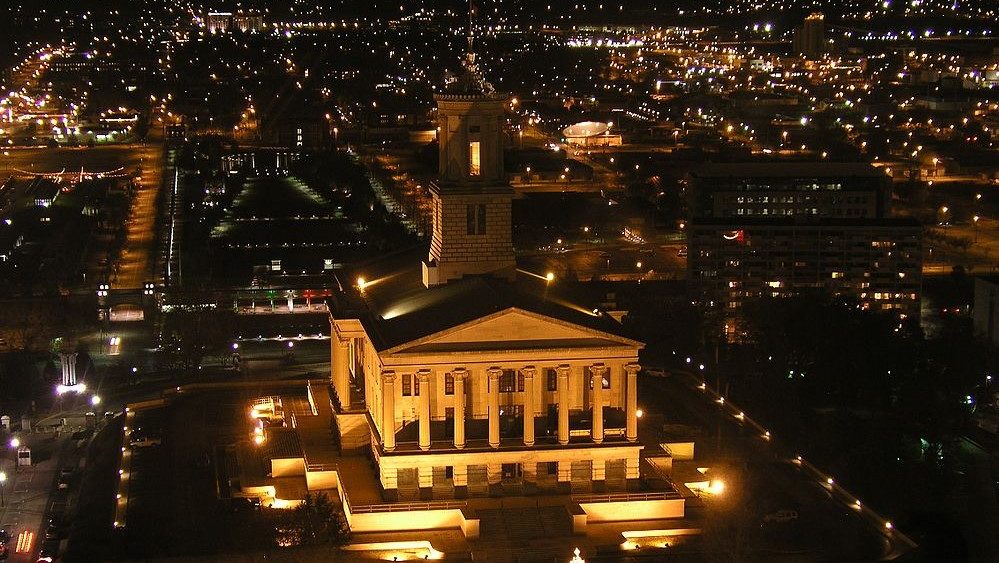

Ask the Experts – Tennessee Gift Laws

Tennessee Capitol Building - Ichabod

Q: I am a registered lobbyist in Tennessee and my employer is planning to invite the entire membership of the general assembly to an in-state reception with food and beverages provided. Is this allowed and is there anything else I […]

Q: I am a registered lobbyist in Tennessee and my employer is planning to invite the entire membership of the general assembly to an in-state reception with food and beverages provided. Is this allowed and is there anything else I should know to make sure I am compliant with state laws?

A: Yes, the event is permissible, but there are important reporting requirements to follow.

Lobbyists and employers of lobbyists may provide entertainment, food, refreshments, etc. in connection with an in-state event to which the entire membership of the general assembly has been invited. For 2023 events, the cost per person may not exceed $73 per day.

The lobbyist or employer of lobbyist must file a copy of the invitation with the Ethics Commission at least 7 days before the event and must file an In-State Disclosure form within 30 days after the event detailing the per-person and total cost of the event.

The aggregate total of all in-state events is also reported on the semi-annual lobbyist employer reports.

Proper gift disclosure can involve more than simply including the gift on your normal lobbying disclosure report. It is always a good idea to check the jurisdiction’s specific disclosure requirements on our website prior to giving a gift.

Q: Our organization is under the impression that we don’t have to register as lobbyists at the Federal level if we keep our lobbying activity isolated to our internal employees and don’t hire outside consultants. I don’t think this is accurate. […]

Q: Our organization is under the impression that we don’t have to register as lobbyists at the Federal level if we keep our lobbying activity isolated to our internal employees and don’t hire outside consultants. I don’t think this is accurate. Can you let me know the registration requirement for federal lobbying?

A: You are correct to be skeptical of this viewpoint. Keeping lobbying activity isolated to in-house personnel does not impact the need to register. Registration at the federal level is based on three criteria. All three must be met in order to warrant registration, or, stated differently, registration is required when all three criteria are met. The criteria are:

- An organization spends or is expected to spend at least $14,000 on lobbying activity during a quarterly period;

- An organization has at least one employee who spends 20% of their time engaged in lobbying activity; and

- That same 20% employee makes more than one lobbying contact.

When considering whether the monetary threshold has been met, all expenses must be considered including, compensation and reimbursed expenses associated with lobbying activities of all employees (not just designated “government relations” employees), overhead, payments to outside lobbyists and the portion of any dues paid to outside membership organization that are allocated toward lobbying. Likewise, when determining whether an individual employee meets the 20% standard, all time engaged in any activity that is intended to support lobbying contacts must be considered including background and prepatory work, research, strategy sessions and conversations inside and outside the organization.

Once your organization meets all three thresholds, registration with the House and Senate is required within 45 days. As a federal registrant, quarterly activity reporting is required as well as semi-annual contribution reporting.

November 14, 2022 •

Can You Tell Me About Lobbying in Arizona? | Ask the Experts

Q: What are the different types of lobbyists in Arizona? Which expenditures are required to be reported on the quarterly or annual report? Do expenditures by my contract firm need to be disclosed? A: In Arizona, there are three main […]

Q: What are the different types of lobbyists in Arizona? Which expenditures are required to be reported on the quarterly or annual report? Do expenditures by my contract firm need to be disclosed?

A: In Arizona, there are three main types of lobbyists required to be listed on the principal registration: the designated lobbyist, authorized lobbyists, and Lobbyists for Compensation (LFC). The designated lobbyist acts as the single point of contact for the principal and is required to file quarterly and annual reports. Authorized lobbyists are employed by the principal for the purpose of lobbying, other than the designated lobbyist, listed on the registration and permitted to perform lobbying activities on behalf of the principal. An LFC is a third-party lobbyist or contract firm compensated for the primary purpose of lobbying on behalf of a principal. While an LFC can act as the designated lobbyist for a principal most companies prefer to use an in-house employee to serve as point of contact for accountability purposes.

The designated lobbyist and each LFC are required to file four separate quarterly reports. The fourth quarter report also requires a cumulative total for the calendar year. While quarterly reports do not require personal expenditures by an authorized lobbyist to be reported, all expenditures must be disclosed in the principal annual report. The principal annual report must also include all reportable expenditures previously disclosed by each LFC on their quarterly reports.

Reportable expenditures provide a benefit to an individual state officer or state employee, whether or not the expenditure was made in the course of lobbying. All expenditures must be reported in one of the following categories: food and beverage; speaking engagement; travel and lodging; flowers; or other expenditures.

Expenditures more than $20 must be itemized and include the name and title of the state officer or employee benefiting; date, amount, and category of expenditure; and the name of the person who made the expenditure on behalf of the principal. Expenditures less than $20 may be reported in the aggregate. Additionally, expenditures for special events require the disclosure of the legislative body invited, date, location, description of event, and the total amount to be disclosed.

August 11, 2022 •

Ask the Experts – Where do I get started?

Q: I have taken on a new role handling our company’s government outreach in Florida. I will likely be lobbying both state and local officials. Where do I get started? A: Florida offers a labyrinth of compliance issues for state […]

Q: I have taken on a new role handling our company’s government outreach in Florida. I will likely be lobbying both state and local officials. Where do I get started?

A: Florida offers a labyrinth of compliance issues for state and local lobbyists. The decentralized nature of the regulatory landscape means you may need to register at the state level, as well as in each individual city or county where you will be active.

At the state level, registration is required prior to engaging in lobbying activities. This includes any attempt to obtain the goodwill of a legislator, executive official, or employee of either branch. Registrants must select whether they will be lobbying the Legislative Branch, Executive Branch, or both. Activity reports for the state are limited to lobbying firms, who must disclose compensation received on a quarterly basis. Gift disclosures may also be required for any registered lobbyist, but we will discuss these in a moment.

Engaging with city or county officials is where staying compliant can be complicated. Most cities and counties have their own registration and reporting ordinances. Luckily, a general theme throughout is the requirement to register prior to engaging with officials. Most locales require annual registration, for either the calendar year or fiscal year, and reporting of lobbying activities. Be careful here to note the reporting periods as they can differ from the registration period. Some cities, such as Orlando, do not require the submission of a report if no expenses were incurred during the reporting period.

Also, be sure to note additional requirements such as meeting logs, lobbyist trainings, or registrations with subgroups of a municipality. For example, Miami-Dade County Publics Schools has its own registration requirement separate from Miami-Dade County.

Finally, whether you are registered with the state or a municipality, state statutes require quarterly disclosures of gifts to certain officials and employees. These reports include gifts valued at more than $25 given to officials or employees who file financial disclosures with the state; however, no such report is required if no reportable gifts were given. And, as always, please be sure any gift is permissible according to the relevant ethics rules.

For more information, be sure to check out the “Registration” and “Reports Required” sections of the Lobbying Compliance Laws online publication for Florida and its municipalities. If you have any questions, please feel free to learn more and contact us at www.stateandfed.com

July 7, 2022 •

Ask the Experts – Hiring Outside Lobbying Firms

Question: I am hiring an outside lobbying firm soon. What sorts of compliance issues should I be watching for? Answer: You no doubt have a list of criteria you use when evaluating an outside firm’s ability to advocate for your […]

Question: I am hiring an outside lobbying firm soon. What sorts of compliance issues should I be watching for?

Answer: You no doubt have a list of criteria you use when evaluating an outside firm’s ability to advocate for your company, but there are other issues you should be looking for.

Many lobbyists are former government officials and staffers, which means they are likely subject to revolving door provisions. While those restrictions will have expired for the majority of lobbyists if there is a new hire at the firm they may still be subject to time or subject matter restrictions and unable to lobby on your behalf. Revolving door restrictions can be a general ban on any lobbying in that jurisdiction, a ban specific to a particular issue in which the former government employee was heavily involved, or a ban only on lobbying their former government agency. If your firm is recommending a lobbyist who recently left government employment, you will want to confirm the lobbyist has no restrictions that will affect their work.

You will also want to ensure the firm is properly filing required registrations and reports. This information is publicly available on state websites, so it is not difficult to determine if the firm is meeting its obligations. Look for reports that are past due and reports that were filed after the due date. This is especially critical if you are going to be relying on the firm to file your company’s principal reports for you.

Finally, search the state’s website for fines, penalties, and reprimands issued to the firm. Again, your company’s reputation, both with the public and with the government officials contacted, will be tied to the firm.

More information about these topics can be found in the Lobbying Compliance Guidebook on the State and Federal Communications subscriber website. Specifically, information regarding revolving door restrictions can be found in the Important Features of the Law section, report due date information can be found in the Reports Required section, and the Contact Information section has links to state ethics websites.

June 13, 2022 •

Ask the Experts – Keeping Compliant while Lobbying in the States

Lady Justice - by Edward Lich from Pixabay

Question: I am planning to give a state legislator a permissible gift. I know I need to include it on my next lobbying disclosure report. Do I need to worry about anything else to make sure I am compliant with […]

Question: I am planning to give a state legislator a permissible gift. I know I need to include it on my next lobbying disclosure report. Do I need to worry about anything else to make sure I am compliant with state laws?

Answer: Yes, some states have additional requirements when an expenditure is made on a covered state official or employee. You may be required to provide the official with a notification or file additional reports.

California requires filers reporting gifts aggregating $50 or more in a calendar year to an official to provide the beneficiary with the date and amount of each gift reportable and a description of the goods or services. This information must be provided to the beneficiary within 30 days following the end of each calendar quarter in which the gift was provided.

In Virginia, lobbyists must send each legislative and executive official who is required to be identified by name on schedule A or B of the Lobbyist’s Disclosure Form a copy of schedule A or B or a summary of the information pertaining to that official. Notifications are due to the official by January 10 for the preceding 12 months. Additionally, lobbyists must send post-session notifications to covered officials summarizing all gifts made by the lobbyist during the period beginning on January 1 complete through adjournment sine die of the regular session.

Maryland requires additional reporting for certain permissible expenditures. A lobbyist who invites all members of a legislative unit to a meal or reception must, at least five days before the date of the meal or reception, extend a written invitation to all members of the legislative unit and register the meal or reception with the Department of Legislative Services on Form 13E by filing the report electronically. A post-event filing is then required within 14 days after the date of the meal or reception meal or reception.

Proper gift disclosure can involve more than simply including the gift on your normal lobbying disclosure reports. It is always a good idea to check the jurisdiction’s specific disclosure requirements on our website prior to giving a gift.

You can find this information under the “Reports Required” section of the U.S. Lobbying Compliance Laws online publication.

May 16, 2022 •

Ask the Experts – Political Contributions Before an Election

QUESTION: Are there any rules that pertain to making contributions in the weeks leading up to an election? ANSWER: With this being an election year, it is wise to know what the rules are when making contributions in the days […]

QUESTION: Are there any rules that pertain to making contributions in the weeks leading up to an election?

ANSWER: With this being an election year, it is wise to know what the rules are when making contributions in the days and weeks leading up to an election. Usually, there is a monetary threshold that must be exceeded and typically there is a short turnaround time to disclose the contribution, usually within 24 hours. In some instances, there is an outright ban on contributions.

In California, contributions of $1,000 or more per candidate made by a major donor during the 90-day period before an election must be disclosed within 24 hours of making the contribution. Contributions to ballot measure committees and political party committees are also included within this reporting requirement. The candidate and the ballot measure committee must be on the ballot at the election for which the 90-day period applies. California’s 90-day pre-election period is the longest in the country. If numerous special elections are being held, the 90-day periods may overlap.

In Washington, a contribution of $1,000 or more per candidate made by a registered lobbyist during the seven days before a primary election and 21 days before the general election must be disclosed within 24 hours of making the contribution. This includes contributions to candidates and ballot measures appearing on the ballot at the election for which the seven day and 21-day period applies, as well as contributions to political party committees and PACs. The Washington Public Disclosure Commission has a link on its home page that allows for the electronic filing of this report.

In Florida, opposed candidates must return contributions received less than five days prior to an election.

In Tennessee, a PAC is prohibited from making a contribution to a candidate for office after the 10th day before an election until the day of the election. This prohibition only applies if the contribution is going to a candidate who is running in that election.

These are just a few examples. As we always advise, verify the rules in your state before making political contributions.

For more information, be sure to check out the “Registration and Reports Required” section of the U.S. Political Contributions Compliance Laws online publication on our website. Please feel free to contact us if you have any questions.

March 11, 2022 •

Ask the Experts – Hiring a Former Public Official

Question: Our company is in the process of hiring a former public official. Are there any issues we should be aware of during this process? Answer: There are some jurisdictions with revolving door policies restricting what former officials or employees […]

Question: Our company is in the process of hiring a former public official. Are there any issues we should be aware of during this process?

Answer: There are some jurisdictions with revolving door policies restricting what former officials or employees can do once they have entered the private sector. These restrictions are in place to avoid the appearance of impropriety.

Many states require a cooling-off period when officials leave office and transition to the private sector. In South Carolina, a former public official is prohibited, for one year after terminating public service or employment, from serving as a lobbyist or representing clients before the agency or department on which the individual formerly served in a matter the individual directly and substantially participated during public service or employment. The restriction also prohibits a former public official from accepting employment if the employment is from a person who is regulated by the agency or department on which the individual served or was employed and involves a matter in which the individual directly and substantially participated during public service or public employment. A public official who participates directly in procurement may not resign and accept employment with a person contracting with the governmental body if the contract falls or would fall under the individual’s official responsibility.

New York law includes a similar restriction but requires a two-year cooling-off period. A former state officer or employee is prohibited, within two years after termination of employment, from appearing or practicing before such state agency or receiving compensation for any services rendered by such former officer or employee on behalf of any person, firm, corporation, or association in relation to any case, proceeding, or application or other matter before such agency. In New York, a former state officer or employee is prohibited, after the termination of employment, from appearing, practicing, communicating, or otherwise rendering services before any state agency or receive compensation for any such services rendered by such former officer or employee on behalf of any person, firm, corporation, or other entity in relation to any case, proceeding, application, or transaction with respect to which such person was directly concerned and in which the individual personally participated during the period of service or employment or which was under the individual’s active consideration.

These are just a few examples of revolving door restrictions. We advise you follow best practices to verify the rules in your jurisdiction.

—

Here is your chance to “Ask the Experts” at State and Federal Communications, Inc. Send your questions to experts@stateandfed.com. (Of course, we have always been available to answer from clients that are specific to your needs, and we encourage you to continue to call or email us with questions about your particular company or organization. As always, we will confidentially and directly provide answers or information you need.) Our replies are not legal advice, just our analysis of laws, rules, and regulations.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.