Virginia State Capitol - KWL / CC BY-SA

The Virginia Legislature officially passed and adopted Gov. Glenn Youngkin’s recommendation concerning Senate Bill 1427, which relates to campaign finance laws, political action committees (PACs), and certain large pre-election expenditures. The bill changes some of the reporting dates while also […]

The Virginia Legislature officially passed and adopted Gov. Glenn Youngkin’s recommendation concerning Senate Bill 1427, which relates to campaign finance laws, political action committees (PACs), and certain large pre-election expenditures.

The bill changes some of the reporting dates while also adding an additional report.

The reports previously due on July 15 and October 15 will be due on June 1 and September 15 with an additional report due on October 15.

PACs must also report any single contribution received or expenditure made of $1,000 or more between the dates of May 26 and the third Tuesday in June, and between October 8 and the date of the November general election.

The bill will take effect on July 1.

Q: As a registered lobbyist, I am often contacted by elected officials to make a corporate contribution to the officials’ charity of choice, foundation, or scholarship fund. Is this legal? Am I required to disclose these contributions on my lobbying […]

Q: As a registered lobbyist, I am often contacted by elected officials to make a corporate contribution to the officials’ charity of choice, foundation, or scholarship fund. Is this legal? Am I required to disclose these contributions on my lobbying reports?

A: This scenario is happening more and more every day. Even though the official does not derive direct, political contributions for his or her campaign, such charitable contributions nonetheless result in positive exposure for the official, goodwill by the lobbyist, and beneficiaries that include the underprivileged, the sick, and the elderly. Furthermore, the monetary amount of corporate charitable donations can surpass the amount of permissible political contributions under campaign finance law.

Most states allow a lobbyist’s employer to make charitable contributions at the behest of an elected official and there are no reporting obligations. Some of the other jurisdictional requirements include:

FEDERAL: Pursuant to House and Senate Rules, charitable contributions made by a registered lobbyist at the behest or designation of a legislative member or employee are prohibited, unless the member or employee has designated the contribution to a charitable organization in lieu of an honorarium.

Please note, however, a charitable organization established by a person before that person became a covered official and where that covered official has no relationship to the organization after becoming a covered official, is not considered to be established by a covered official.

CALIFORNIA: Payments may be made at the behest of a state elected officer for a charitable, legislative, or governmental purpose. The state official must report the payment.

CONNECTICUT: If a client lobbyist makes a charitable contribution at the behest of a public official, the contribution generally will be deemed to have been made to foster goodwill with the public official and hence to constitute an expenditure in furtherance of lobbying. If deemed in furtherance of lobbying, the expenditure must be reported on the client lobbyist’s ETH-2D report as lump sum under “Other Expenses.”

DELAWARE: Charitable contributions made at the behest of an official are required to be disclosed on lobbying reports. A charitable contribution made at the behest of a legislator must be reported as a gift. If the amount is over $50, it must be itemized and the specific legislator must be named. A notation may be made if it was a donation to a charity.

NEW YORK: A state official may not designate or recommend a third party to receive a gift, and no prohibited gift may be offered to, or received by, a third party under circumstances in which it would be reasonable to infer the gift was intended to influence a public official. In other words, an interested source is presumptively prohibited from giving a gift to a third party, even a charity, at the behest of a public official.

A gift offered on behalf of or at the designation or recommendation of a public official is only permissible if, under the circumstances, all of the following criteria are met:

It is not reasonable to infer the gift was intended to influence such public official;

The gift could not reasonably be expected to influence the public official in the performance of his or her official duties; and

It is not reasonable to infer the gift was intended as a reward for any official action on the public official’s part.

NEVADA: Charitable contributions are reportable if made in the legislator’s name. A registered lobbyist is required to report the total expenditures made to any other person on behalf and for the benefit of a legislator.

March 16, 2023 •

Ohio Contribution Limits Increased

Ohio Statehouse

The Ohio office of Secretary of State has published increased contribution limits. The contribution limits for PACs, PCEs and individuals may contribute to statewide candidates, candidates for General Assembly, county parties, PACs, and PCEs increased from $13,704.41 to $15,499.69 per […]

The Ohio office of Secretary of State has published increased contribution limits.

The contribution limits for PACs, PCEs and individuals may contribute to statewide candidates, candidates for General Assembly, county parties, PACs, and PCEs increased from $13,704.41 to $15,499.69 per election; and from $41,113.24 to $46,499.08 per calendar year to state parties; and from $20,556.62 to $23,249.54 per calendar year to legislative campaign funds.

The amount of gifts corporations and labor unions may provide per year to a state political party, county political party, or legislative campaign fund, for certain specified purposes, such as facilities; equipment, and supplies, increased from $11,274.23 to $12,751.16.

March 9, 2023 •

Wyoming Legislature Adjourns Sine Die

Wyoming Capitol - By Bradlyons

The Wyoming State Legislature adjourned sine die March 3, after passing 196 bills during the 37-day session. Among the passed bills, the legislature ratified Senate Bill 40. Senate Bill 40 closed an exemption for federal political action committees (PACs) active […]

The Wyoming State Legislature adjourned sine die March 3, after passing 196 bills during the 37-day session.

Among the passed bills, the legislature ratified Senate Bill 40. Senate Bill 40 closed an exemption for federal political action committees (PACs) active in Wyoming elections.

Under the new law, federal PACs must file state campaign finance reports unless they are solely making contributions or expenditures to federal candidates or issues.

Other major bills passed during the quick session include universal tax-relief and an omnibus bill focusing on rehabilitating the state’s water infrastructure.

March 9, 2023 •

Governor Mark Gordon Signs Senate Bill 40

Gov. Mark Gordon - by MikesGroover

Gov. Mark Gordon has signed a bill removing an exemption from state campaign finance reporting for federal political action committees (PACs) active in Wyoming elections. Senate Bill 40 requires federal PACs to report in Wyoming unless they are making contributions […]

Gov. Mark Gordon has signed a bill removing an exemption from state campaign finance reporting for federal political action committees (PACs) active in Wyoming elections.

Senate Bill 40 requires federal PACs to report in Wyoming unless they are making contributions or expenditures only to federal candidates or federal issues.

The law takes effect July 1.

February 21, 2023 •

Vermont Raises Contribution Limits

Vermont Capitol Building

The Vermont state’s Elections Division increased contribution limits. Under the revised limits, contributions of up to $1,120 per election cycle may be made to state representative candidates, and contributions of up to $1,680 per election cycle may be made to […]

The Vermont state’s Elections Division increased contribution limits.

Under the revised limits, contributions of up to $1,120 per election cycle may be made to state representative candidates, and contributions of up to $1,680 per election cycle may be made to state senate candidates.

Individuals and PACs may contribute up to $4,480 to statewide candidates and PACs per election cycle.

The adjusted limits represent a 6.4% increase for the entire 2024 election cycle.

February 20, 2023 •

Maine Contribution Limits Increased

Maine Capitol Building

Maine’s Commission on Governmental Ethics and Elections Practices raised contribution limits. Individuals and PACs may now contribute up to $1,950 per election to gubernatorial candidates, up to $475 per election to legislative candidates, and up to $575 per election for […]

Maine’s Commission on Governmental Ethics and Elections Practices raised contribution limits.

Individuals and PACs may now contribute up to $1,950 per election to gubernatorial candidates, up to $475 per election to legislative candidates, and up to $575 per election for municipal candidates.

The next adjustment to contribution limits is expected to occur in January 2025

January 17, 2023 •

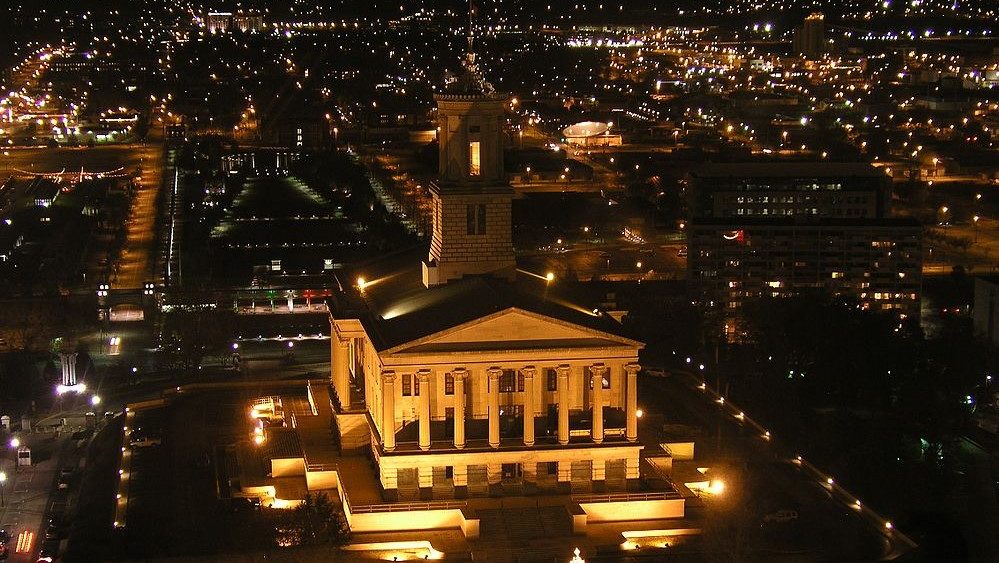

Tennessee Contribution Limits Increase

Tennessee Capitol Building - Ichabod

The Tennessee Bureau of Ethics and Campaign Finance (BECF) published revised contribution limits for 2023 and 2024. The per person limit to candidates for statewide office increased from $4,300 to $4,900 per election. The per person limit for the Senate, […]

The Tennessee Bureau of Ethics and Campaign Finance (BECF) published revised contribution limits for 2023 and 2024.

The per person limit to candidates for statewide office increased from $4,300 to $4,900 per election.

The per person limit for the Senate, House, and all other state and local offices increased from $1,600 to $1,800.

PAC limits to candidates for statewide office and for the House increased from $12,700 to $14,400 per election.

PAC limits to candidates for Senate increased from $25,400 to $28,800.

All other state and local office candidates receiving contributions from a PAC increased from $8,300 to $9,400 per election.

BECF adjusts contribution limits in January of each odd-numbered year based on the consumer price index.

January 3, 2023 •

Illinois 2023 Campaign Contribution Limits Published

State Flag of Illinois

The State Board of Elections published the new contribution limits summary sheet, which increases limits on January 1 of every odd-numbered year to reflect increases in inflation. The amount corporations and labor organizations may contribute in each election cycle increased […]

The State Board of Elections published the new contribution limits summary sheet, which increases limits on January 1 of every odd-numbered year to reflect increases in inflation.

The amount corporations and labor organizations may contribute in each election cycle increased from $12,000 to $13,700 to any candidate committee; from $24,000 to $27,400 to any political party or legislative caucus committee; and from $24,000 to $27,400 to any PAC.

The amount an individual may contribute in each election cycle increased from $6,000 to $6,900 to any candidate committee; from $12,000 to $13,700 to any political party or legislative caucus committee; and from $12,000 to $13,700 to any PAC.

The amount PACs are limited to contributing to any candidate committee, political party committee, legislative caucus committee, or PAC each election cycle increased from $59,900 to $68,500.

April 1, 2021 •

Georgia General Assembly Adjourns Sine Die

Georgia State Capitol Building

Georgia’s 2021 Legislative session adjourned sine die on March 31. Among the measures passed is Senate Bill 202, which was signed into law by Gov. Brian Kemp on March 25 and made sweeping changes to the State’s voting laws, including […]

Georgia’s 2021 Legislative session adjourned sine die on March 31.

Among the measures passed is Senate Bill 202, which was signed into law by Gov. Brian Kemp on March 25 and made sweeping changes to the State’s voting laws, including bans on mass mailings of unsolicited absentee ballot requests and polling places on buses among other changes.

Another controversial bill, Senate Bill 221, also passed and currently awaits gubernatorial approval.

Senate Bill 221 allows certain elected officials to chair and register PACs called a leadership committee which is not subject to the in-session contribution ban.

Further, contributions to and expenditures by these leadership committees are not subject to the state’s contribution limits.

Governor Kemp will have just over a month to consider action on Senate Bill 221, as well as, the other bills passed during the session.

January 12, 2021 •

Arizona Increases Campaign Contribution Limits

Arizona State Capitol - by Visitor7

The Arizona Secretary of State’s Office has increased contribution limits for the 2021-2022 election cycle. Effective January 1, an individual may not contribute more than $5,300 per election cycle to a candidate committee for statewide office and legislative office. Additionally, […]

The Arizona Secretary of State’s Office has increased contribution limits for the 2021-2022 election cycle.

Effective January 1, an individual may not contribute more than $5,300 per election cycle to a candidate committee for statewide office and legislative office. Additionally, an individual may not contribute more than $6,550 per election cycle to a candidate committee for district office, county office, town office, and city office.

Contribution limits for PACs have also increased. A PAC without Mega PAC status may not contribute more than $5,300 per election cycle to a candidate for statewide office. In contrast, a PAC with Mega PAC status may contribute $10,600 per election cycle to candidates for statewide and legislative office and $13,100 per election cycle to candidates for county, city, town, or district office.

February 13, 2020 •

Federal Lobbyist Bundling Disclosure Threshold Increased to $19,000

Today, the Federal Election Commission (FEC) published its price index adjustments for expenditure limitations and the federal lobbyist bundling disclosure threshold. The lobbyist bundling disclosure threshold has increased for 2020 from $18,700 to $19,000. This threshold amount is adjusted annually. […]

Today, the Federal Election Commission (FEC) published its price index adjustments for expenditure limitations and the federal lobbyist bundling disclosure threshold.

The lobbyist bundling disclosure threshold has increased for 2020 from $18,700 to $19,000. This threshold amount is adjusted annually.

Federal law requires authorized committees of federal candidates, leadership political action committees (PACs), and political party committees to disclose contributions bundled by lobbyists and lobbyists’ PACs.

Additionally, the FEC published its adjusted Coordinated Party Expenditure Limits for political parties for 2020.

February 13, 2020 •

Idaho Election Filing Deadlines Extended

Idaho Capitol Building - JSquish

At the request of Idaho Secretary of State Lawerence Denney, and in consultation with the office of the Governor, the Idaho Office of the Secretary of State is extending the February 10 filing deadline for PACs and candidates under the […]

At the request of Idaho Secretary of State Lawerence Denney, and in consultation with the office of the Governor, the Idaho Office of the Secretary of State is extending the February 10 filing deadline for PACs and candidates under the Idaho Sunshine Laws to February 17, 2020.

Being the first report due under the new revisions of the Sunshine Law, various unanticipated issues have made achieving the deadline by midnight unlikely for some candidates and PACs.

The fines stipulated by the new laws will also be pushed back and not be assessed at this time.

Another contributing factor to the delayed deadline is for many in local and special district offices, this report represents their first time ever filing with the Office of the Secretary of State and many were not aware of the steps required to gain access to the state’s campaign finance filing system.

January 8, 2020 •

Seattle City Council Considering Caps on Super PAC Donations

Seattle City Hall - Rootology

The Seattle City Council is considering legislation limiting the ability of Super PACs to spend unlimited amounts of money in Seattle elections. Council Member Lorena González introduced the Clean Campaigns Act to reduce the amount of money Super PACs funnel […]

The Seattle City Council is considering legislation limiting the ability of Super PACs to spend unlimited amounts of money in Seattle elections.

Council Member Lorena González introduced the Clean Campaigns Act to reduce the amount of money Super PACs funnel into elections.

The proposed legislation would limit Super PACs from receiving more than $5,000 per year from any single individual or corporation.

The act would also block multinational corporations, defined as companies with more than one percent ownership from a single foreign national or more than five percent ownership from multiple foreign nationals, from spending money on local elections.

Another proposed change would require all political advertising outside of election years to follow similar reporting requirements to current rules for election advertisements.

The Clean Campaigns Act is currently being considered in council chambers and could see a full council vote as early as next week.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.