May 8, 2024 •

The Lifetime Lobbying Ban Act Introduced in Congress

The Lifetime Lobbying Ban Act was in introduced in the U.S. House of Representatives. The short three-page bill, which would repeal the current one- or two-year waiting period for former members of Congress to work as a federal lobbyist and […]

The Lifetime Lobbying Ban Act was in introduced in the U.S. House of Representatives.

The short three-page bill, which would repeal the current one- or two-year waiting period for former members of Congress to work as a federal lobbyist and replace it with a permanent ban, was introduced on April 30.

On the same day U.S. Rep. Jared F. Golden introduced the legislation along with five other bills addressing governmental ethics.

These include, as described in his press release:

- The Congressional and Executive Foreign Lobbying Ban, which would ban retired members of Congress, senior executive branch officials, and high-ranking military officials from lobbying on behalf of foreign interests;

- The Stop Foreign Payoffs Act, which would ban members of Congress, presidents, vice presidents, and Cabinet secretaries, as well as their close family members, from earning a salary or holding investments in foreign businesses for as long as the official is in office;

- The Crack Down on Dark Money Act, which would end the ability of mega-donors to launder secret political activity through 501(c)(4) nonprofits by reducing the cap on political activity by those nonprofits from 50 percent of all spending to 10 percent and requiring them to disclose all donors of $5,000 or more if there are political expenditures;

- The Consistent Labeling for Political Ads Act, which would increase transparency in online political advertising by requiring social media platforms to make ad labels “sticky,” meaning they would appear on paid political content regardless of how it is shared or where it appears; and

- The Fighting Foreign Influence Act, which would require tax-exempt organizations, including think tanks, to disclose high-dollar gifts from foreign governments or political parties, impose a lifetime ban on foreign lobbying by former presidents, vice presidents, senior military officials and require political campaigns to verify online donors have a valid US address.

According to Golden’s press release, this raft of bills is part of the Government Integrity & Anti-Corruption Plan, which has the stated goal of strengthening government integrity and fighting corruption.

January 8, 2024 •

Minimum Wage Required by Federal Contractors Increases for 2024

Washington DC Skyline - by Washington Photo Safari

For 2024, the minimum wage required to be paid by US Federal Contractors under Executive Order 14026 increases to $17.20 an hour. Starting on January 30, 2022, all federal agencies were required to incorporate a $15 minimum wage in new […]

For 2024, the minimum wage required to be paid by US Federal Contractors under Executive Order 14026 increases to $17.20 an hour.

Starting on January 30, 2022, all federal agencies were required to incorporate a $15 minimum wage in new contract solicitations pursuant to an executive order signed by President Joseph R. Biden on April 27, 2021.

The order requires federal contractors to pay a minimum wage for employees working on or in connection with a federal government contract.

Beginning January 1, 2024, and for each subsequent year, tipped workers must now receive 100% of the wage received by non-tipped workers, currently $17.20 an hour, eliminating the difference between the type of workers.

This applies to tipped employees performing work on or in connection with contracts covered by Executive Order 14026.

Contractors and subcontractors must certify they meet this condition requiring the minimum wage.

This certification is a condition of payment to the contractors from the government.

The order does not apply to grants; contracts, contract-like instruments, or certain specific type of agreements with Indian Tribes.

If a state or municipality has a higher minimum wage, the Executive Order does not excuse noncompliance with the laws requiring the higher wage.

December 1, 2023 •

Rep. George Santos Expelled from U.S. House of Representatives

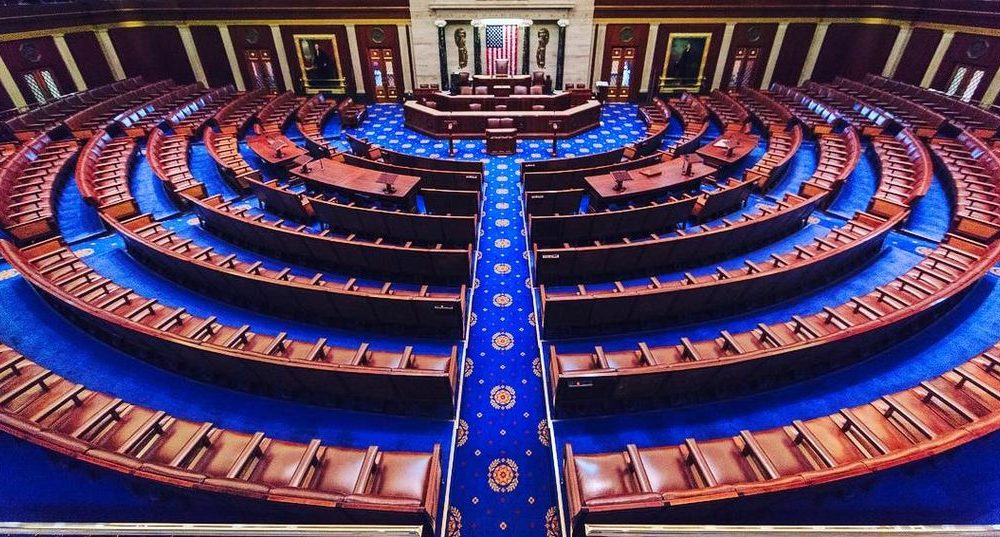

U.S. House of Representatives Chamber - from their Public Domain

On December 1, over two-thirds of the United States House of Representatives voted to expel Rep. George Santos. The resolution to expel him from Congress passed 311 to 114, with 105 Republicans and all but two Democrats voting to remove […]

On December 1, over two-thirds of the United States House of Representatives voted to expel Rep. George Santos.

The resolution to expel him from Congress passed 311 to 114, with 105 Republicans and all but two Democrats voting to remove him.

On November 16, the Investigative Subcommittee of the House Committee on Ethics completed its investigation and unanimously concluded that there was substantial evidence that Santos:

- Knowingly caused his campaign committee to file false or incomplete reports with the Federal Election Commission;

- Used campaign funds for personal purposes;

- Engaged in fraudulent conduct in connection with RedStone Strategies LLC; and

- Engaged in knowing and willful violations of the Ethics in Government Act as it relates to his Financial Disclosure Statements filed with the House.

The committee then immediately referred these allegations to the Department of Justice, according to the Committee’s press release.

Santos is only the sixth member of the House to be removed by this type of vote in its history.

The last member removed was Rep. James A. Traficant in 2002.

A special election to fill the now-vacant seat is expected to be announced by New York Governor Kathy Hochul.

August 10, 2023 •

Federal Judge Strikes Down Restriction On Lobbyists

Florida State Flag

U.S. District Judge Beth Bloom of the Southern District of Florida permanently halted a portion of the lobbying ban approved by voters in 2018. The restriction barred public officials from lobbying, on issues of policy, appropriations, or procurement before governmental […]

U.S. District Judge Beth Bloom of the Southern District of Florida permanently halted a portion of the lobbying ban approved by voters in 2018.

The restriction barred public officials from lobbying, on issues of policy, appropriations, or procurement before governmental bodies or entities while in office.

Bloom determined the amendment language to be too broad and poorly defined, agreeing with the Plaintiffs in the case.

The six-year ban on lobbying pertaining to former state and local officers after leaving office was not blocked by Bloom and will continue to be in effect.

US Capitol - by Martin Falbisoner via Wikimedia Commons

On May 2, U.S. Rep. Yvette D. Clarke introduced legislation into the U.S. House of Representatives to require disclosure of political campaign content created by artificial intelligence. House Bill 3044 amends the Federal Election Campaign Act of 1971 (FECA) to […]

On May 2, U.S. Rep. Yvette D. Clarke introduced legislation into the U.S. House of Representatives to require disclosure of political campaign content created by artificial intelligence.

House Bill 3044 amends the Federal Election Campaign Act of 1971 (FECA) to provide transparency and accountability for the use of content generated by artificial intelligence (generative AI) in political advertisements. It requires such advertisements to include a statement within the contents of the advertisements if generative AI was used to generate any image or video footage in the advertisements. The bill also expands FECA’s definitions of online platform.

If passed, the Federal Election Commission (FEC) would be required to make regulations within 120 days of the day of the enactment of the bill. Additionally, the bill explicitly states the legislation would come into effect on or after January 1, 2024, even if the FEC has not yet promulgated regulations to carry out the new law.

The bill, entitled the Require the Exposure of AI–Led Political Advertisements Act (REAL Political Advertisements Act) has been referred to the House Committee on House Administration.

January 6, 2023 •

Minimum Wage Required by Federal Contractors Increases for 2023

Pres. Biden - by: Gage Skidmore

For 2023, the minimum wage required to be paid by US Federal Contractors under Executive Order 14026 increases to $16.20 an hour. Beginning January 30, 2022, all federal agencies were required to incorporate a $15 minimum wage in new contract […]

For 2023, the minimum wage required to be paid by US Federal Contractors under Executive Order 14026 increases to $16.20 an hour.

Beginning January 30, 2022, all federal agencies were required to incorporate a $15 minimum wage in new contract solicitations pursuant to an executive order signed by President Joseph R. Biden on April 27, 2021.

The order requires federal contractors to pay a minimum wage for employees working on or in connection with a federal government contract.

Tipped employees performing work on or in connection with contracts covered by Executive Order 14026 must be paid a minimum cash wage of $13.75 per hour.

Contractors and subcontractors must certify they meet this condition requiring the minimum wage. This certification is a condition of payment to the contractors from the government. The order does not apply to grants; contracts, contract-like instruments, or certain specific type of agreements with Indian Tribes.

For 2023, tipped workers received 85% of the wage rate in effect for non-tipped employees, rounded to the nearest multiple of $0.05. Beginning January 1, 2024, and for each subsequent year, tipped workers must receive 100% of the wage received by non-tipped workers, eliminating the difference between the type of workers. Adjustments must be considered by employers of tipped workers who do not receive a sufficient additional amount on account of tips to equal to the minimum wage of non-tipped workers.

If a state or municipality has a higher minimum wage, the Executive Order does not excuse noncompliance with the laws requiring the higher wage.

November 14, 2022 •

FEC Considering Internet Disclaimers on Political Ads

FEC; Photo: Sarah Silbiger/CQ Roll Call

On November 17, the Federal Election Commission (FEC) will consider updating regulations concerning disclaimers on public communications on the internet. The 48-page draft to be considered relates to adopting final regulatory rules “in light of technological advances since the Commission […]

On November 17, the Federal Election Commission (FEC) will consider updating regulations concerning disclaimers on public communications on the internet.

The 48-page draft to be considered relates to adopting final regulatory rules “in light of technological advances since the Commission last revised its rules governing internet disclaimers in 2006, and to address questions from the public about the application of those rules to internet communications,” according to the memorandum submitted for the upcoming FEC meeting.

The goal of these proposals is to apply the Federal Election Campaign Act’s disclaimer requirements to general public political advertising on the internet and to revise the definition of “public communication” to clarify how it applies to such advertising.

May 18, 2022 •

FEC Revised PAC Organizational Form Now Available

FEC; Photo: Sarah Silbiger/CQ Roll Call

On May 17, the Federal Election Commission (FEC) made available its updated FEC Form 1, the Statement of Organization for Political Committees, which now includes designations for superPACs and Hybrid Committees. SuperPACs, which are technically independent expenditure-only political committees, and […]

On May 17, the Federal Election Commission (FEC) made available its updated FEC Form 1, the Statement of Organization for Political Committees, which now includes designations for superPACs and Hybrid Committees.

SuperPACs, which are technically independent expenditure-only political committees, and Hybrid Committees, which in turn are committees with separate non-contribution accounts, were required to file separate letters along with the old FEC Form 1 to receive those designations.

Additionally, the FEC has also released a new version of FECFile, its Windows-based software system committees can use for electronic filing, and a new version of its online webform.

April 26, 2022 •

OGE Proposes Ethics Rules for Federal Employees Legal Defense Funds

USOGE

The public has until June 21 to comment on a proposed rule allowing federal employees to accept gifts of certain legal costs. The proposed rule would create new federal regulations governing a federal employee’s acceptance of payments for legal expenses […]

The public has until June 21 to comment on a proposed rule allowing federal employees to accept gifts of certain legal costs.

The proposed rule would create new federal regulations governing a federal employee’s acceptance of payments for legal expenses or pro bono legal services for matters arising in connection with the employee’s official position, the employee’s prior position on a campaign of a candidate for president or vice-president, or the employee’s prior position on a Presidential Transition Team.

The U.S. Office of Government Ethics (OGE) wants to make related amendments governing the solicitation and acceptance of gifts from outside sources and establish limits of the amount of the value of the donations.

They are proposing a contribution limit of $10,000 per year from any single permissible donor to a legal expense fund. The fund would be required to be formed as a trust for employees to receive contributions and to make distributions of legal expense payments. Lobbyists would be prohibited from acting as trustees administering an employee’s legal expense fund.

Additionally, federal employees would be prohibited from accepting pro bono services from lobbyists, foreign governments or agents, or persons substantially affected by the performance or nonperformance of the employees’ duties.

According to the OGE, there are currently no statutory or regulatory frameworks in the executive branch for establishing a legal expense fund. The proposed rule was published on April 21 in the Federal Register.

April 20, 2022 •

Super PACs Must Report LLC Attributions

FEC; Photo: Sarah Silbiger/CQ Roll Call

“Going forward,” the Federal Election Commission (FEC) will require disclosure requirements for contributions received from limited liability companies (LLCs) be applied to independent expenditure-only political committees (i.e., Super PACs) in the same manner in which they are applied to all […]

“Going forward,” the Federal Election Commission (FEC) will require disclosure requirements for contributions received from limited liability companies (LLCs) be applied to independent expenditure-only political committees (i.e., Super PACs) in the same manner in which they are applied to all other political committees.

On April 15, four of the six commissioners issued a “Statement of Reasons” for their conclusion of a closeout of a complaint. In the statement, which refers to Matters Under Review (MUR) 7454, Chairman Allen Dickerson, Vice Chair Steven T. Walther, Commissioner Shana M. Broussard, and Commissioner Ellen L. Weintraub assert, “contributions from LLCs to committees must be attributed pursuant to Commission regulations, and those regulations apply to all committees, including [Super PACs]. The Commission will apply that understanding going forward, and may seek civil penalties in appropriate future cases.”

In MUR 7454, the Super PAC in question had not obtained the required attribution information for two contributions made by LLCs. The Super PAC attributed the contributions only to the LLCs. Regulations require committees to report certain attribution information for contributions from LLCs.

An LLC that has a single natural-person member and is not taxed as a corporation must be attributed only to the natural person member, and not the LLC. A contribution by an LLC that is disregarded for tax purposes and does not have a single natural-person member is treated as a partnership contribution; and, a partnership contribution must be attributed to both the partnership and each partner, either in proportion to his or her share of the partnership profits or by agreement among the partners.

In prior cases premised on similar facts, the FEC could not agree whether, following the Citizens United and SpeechNow.org v. FEC court decisions, LLC reporting rules and conduit contribution rules applied to contributions made to the newly formed Super PACs authorized by those judicial rulings. The commissioners determined that “with the passage of time, [Super PACs] have become a regular part of the campaign finance landscape, and…there is no longer a lack of clarity concerning the application of LLC reporting rules and conduit contribution rules in these circumstances.”

Because the FEC has not previously made this conclusion under similar cases, they did not seek a civil penalty against the Super PAC.

Pres. Biden - by: Gage Skidmore

Today is the last day for all federal agencies to have ensured they have incorporated a $15 minimum wage in any of their new contract solicitations. On April 27, 2021, President Joseph R. Biden had signed an executive order requiring […]

Today is the last day for all federal agencies to have ensured they have incorporated a $15 minimum wage in any of their new contract solicitations.

On April 27, 2021, President Joseph R. Biden had signed an executive order requiring federal contractors to pay $15 per hour for employees working on or in connection with a federal government contract. On November 22, 2021, Secretary of Labor Martin J. Walsh announced the final rule implementing the president’s order. In turn, on March 30, 2022, all federal agencies need to implement the minimum wage into new contracts.

Federal agencies are also directed to implement the higher wage into existing contracts when the parties exercise their option to extend such contracts. Contractors and subcontractors must certify they will meet this condition requiring the minimum wage. This certification is a condition of payment to the contractors from the government. The order applies, with certain exceptions, to any new contract; new contract-like instrument; new solicitation; extension or renewal of an existing contract or contract-like instrument; or exercise of an option on an existing contract or contract-like instrument.

This order does not apply to grants; contracts, contract-like instruments, or certain specific type of agreements with Indian Tribes.

Starting January 1, 2023, the minimum wage will be adjusted annually, but not lowered, by the U.S. secretary of labor based on a consumer price index formula and rounded to the nearest multiple of $0.05. For tipped workers, the minimum wage mandated by the order is $10.50 per hour beginning January 30, 2022. Beginning January 1, 2023, tipped workers must receive 85% of the wage rate in effect for non-tipped employees, rounded to the nearest multiple of $0.05.

Then beginning January 1, 2024, and for each subsequent year, tipped workers must receive 100% of the wage received by non-tipped worker, eliminating the difference between the type of workers. Adjustments must be considered by employers of tipped workers who do not receive a sufficient additional amount on account of tips to equal to the minimum wage of non-tipped workers. If a state or municipality has a higher minimum wage, the Executive Order does not excuse noncompliance with the laws requiring the higher wage.

January 31, 2022 •

Process Begins for $15 Minimum Wage in Federal Contracts

Washington DC Skyline - by Washington Photo Safari

On January 30, the process began for federal agencies to begin incorporating a $15 minimum wage in new contract solicitations. By March 30, 2022, all agencies will need to implement the minimum wage into new contracts. Federal agencies are also […]

On January 30, the process began for federal agencies to begin incorporating a $15 minimum wage in new contract solicitations. By March 30, 2022, all agencies will need to implement the minimum wage into new contracts. Federal agencies are also directed to implement the higher wage into existing contracts when the parties exercise their option to extend such contracts.

On April 27, 2021, President Joseph R. Biden had signed an executive order requiring federal contractors to pay $15 per hour for employees working on or in connection with a federal government contract. The Department of Defense, the General Services Administration, and the National Aeronautics and Space Administration issued an interim rule order on January 26, 2022, amending the Federal Acquisition Regulations to implement the executive order. Contractors and subcontractors for all federal agencies must certify they meet the conditions requiring the minimum wage. This certification is a condition of payment to the contractors from the government. The order applies, with certain exceptions, to any new contract; new contract-like instrument; new solicitation; extension or renewal of an existing contract or contract-like instrument; or exercise of an option on an existing contract or contract-like instrument. This order does not apply to grants; contracts, contract-like instruments, or certain specific type of agreements with Indian Tribes.

Starting January 1, 2023, the minimum wage will be adjusted annually, but not lowered, by the U.S. secretary of labor based on a consumer price index formula and rounded to the nearest multiple of $0.05. For tipped workers, the minimum wage mandated by the order is $10.50 per hour beginning January 30, 2022. Beginning January 1, 2023, tipped workers must receive 85% of the wage rate in effect for non-tipped employees, rounded to the nearest multiple of $0.05. Then beginning January 1, 2024, and for each subsequent year, tipped workers must receive 100% of the wage received by non-tipped worker, eliminating the difference between the type of workers. Adjustments must be considered by employers of tipped workers who do not receive a sufficient additional amount on account of tips to equal to the minimum wage of non-tipped workers. If a state or municipality has a higher minimum wage, the Executive Order does not excuse noncompliance with the laws requiring the higher wage.

December 17, 2021 •

FEC Chooses Allen Dickerson as Chair for 2022

FEC; Photo: Sarah Silbiger/CQ Roll Call

On December 16, the Federal Election Commission elected Commissioner Allen Dickerson as its chairman for 2022. Dickerson will replace current Chairwoman Shana M. Broussard. The chairmanship is a rotating, one-year position.No commissioner may serve as chair more than once during […]

On December 16, the Federal Election Commission elected Commissioner Allen Dickerson as its chairman for 2022.

Dickerson will replace current Chairwoman Shana M. Broussard.

The chairmanship is a rotating, one-year position.No commissioner may serve as chair more than once during his or her term.

Additionally, Commissioner Steven T. Walther was elected to the position of vice chair.

December 14, 2021 •

U.S. DOJ Seeks Input on New FARA Rulemaking

The Robert F. Kennedy Department of Justice Building

On December 13, the U.S. Department of Justice (DOJ) formally requested public input regarding future implementation of Foreign Agents Registration Act (FARA) regulations. The regulations have not been amended in 14 years. The DOJ’s Advance Notice of Proposed Rulemaking was […]

On December 13, the U.S. Department of Justice (DOJ) formally requested public input regarding future implementation of Foreign Agents Registration Act (FARA) regulations.

The regulations have not been amended in 14 years.

The DOJ’s Advance Notice of Proposed Rulemaking was published in the Federal Register, Vol. 86, No. 236, seeking public comment to help inform the DOJ’s decision-making prior to its issuance of any new proposed FARA regulations. The DOJ’s National Security Division anticipates issuing a Notice of Proposed Rulemaking that would amend or otherwise clarify the scope of certain exemptions, update various definitions, and make other modernizing changes to the Attorney General’s FARA implementing regulations.

The public comment period ends on February 11, 2022.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.