April 3, 2014 •

State and Federal Communications Team Presents PAC Webinar: Compliance at the State Level

A team of experts from State and Federal Communications is presenting the Public Affairs Council’s Compliance on the State Level webinar this afternoon from 2 p.m. to 3 p.m. ET. Join us for an hour full of compliance information you […]

A team of experts from State and Federal Communications is presenting the Public Affairs Council’s Compliance on the State Level webinar this afternoon from 2 p.m. to 3 p.m. ET. Join us for an hour full of compliance information you need right now.

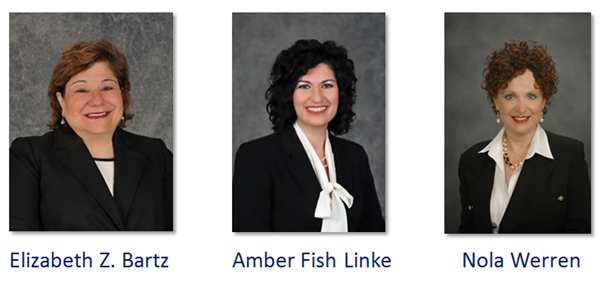

1. Director of Client and Product Operations Amber Fish Linke will start our program by talking about state and local lobbying laws and gift laws.

2. Client Specialist Nola Werren will continue the conversation and discuss the pay-to-play laws, strategies for compliance, and how to avoid violations. She will follow that up with a discussion about state campaign finance laws and where you can make corporate contributions.

3. President and CEO Elizabeth Z. Bartz will round out the discussion with what to watch for in the procurement process.

Riveting conversation for a Thursday afternoon … but so important to know in 2014. If you haven’t already, take the time to register now for the webinar by going to www.pac.org or contact Piper Evans, manager of the council’s Government Relations Practice, at 202-787-5978 or pevans@pac.org.

Your company’s reputation in its home state and where it has business operations depends on it. As we are preparing our program if you have a specific question to ask, please send me an e-mail at ebartz@stateandfed.com.

April 3, 2014 •

Saskatchewan Passes Lobbyists Act

After more than two years of debate, the Legislative Assembly of Saskatchewan passed a bill containing a lobbyist registration scheme. Under the new law, lobbyists, as defined therein, must register and file activity reports online. There are several notable provisions […]

After more than two years of debate, the Legislative Assembly of Saskatchewan passed a bill containing a lobbyist registration scheme. Under the new law, lobbyists, as defined therein, must register and file activity reports online.

There are several notable provisions excepting some individuals from the registration requirement, including officers, directors, or employees, when acting in their official capacity, of the Saskatchewan Urban Municipalities Association, the Saskatchewan Association of of Rural Municipalities, and the Saskatchewan School Boards Association. The bill also contains revolving door restrictions, prohibiting former public officials from lobbying within one year of leaving office.

The act becomes effective upon proclamation by the Lieutenant Governor. Justice Minister Gordon Wyant estimates no such proclamation will be issued for at least nine months, as the province must still develop protocols to administer and enforce the new law.

April 3, 2014 •

Wisconsin Aggregate Limits Expected to Fall

The aggregate contribution limits for individuals and PACs contributing to state candidates are expected to be unenforceable following the Supreme Court’s McCutcheon v. Federal Election Commission repeal of federal aggregate limits. The federal case challenging Wisconsin’s aggregate limits has been […]

The aggregate contribution limits for individuals and PACs contributing to state candidates are expected to be unenforceable following the Supreme Court’s McCutcheon v. Federal Election Commission repeal of federal aggregate limits. The federal case challenging Wisconsin’s aggregate limits has been on hold pending McCutcheon. Young v. GAB seeks to remove aggregate limits set to prohibit even a $1 contribution if the individual donor has given the maximum $10,000 contribution to a single candidate.

The Government Accountability Board (GAB) has moved to dismiss the case, arguing the complaint does not sufficiently allege Mr. Young is harmed by the limit.

April 2, 2014 •

Analysis of U.S. Supreme Court McCutcheon Majority Decision: Aggregate Political Contributions Found Unconstitutional

Today, in McCutcheon v. Federal Election Commission (docket 12-536), the United States Supreme Court ruled aggregate limits on federal campaign contributions are an unconstitutional violation of the First Amendment’s guarantee of political expression and association. Background: Federal law imposes two […]

Today, in McCutcheon v. Federal Election Commission (docket 12-536), the United States Supreme Court ruled aggregate limits on federal campaign contributions are an unconstitutional violation of the First Amendment’s guarantee of political expression and association.

Background:

Federal law imposes two types of limits on individual political contributions.

Base limits restrict the amount an individual may contribute to:

- A candidate committee;

- A national party committee;

- A state, local, and district party committee; and

- A political action committee.

Biennial limits restrict the aggregate amount an individual may contribute biennially to:

- Candidate committees; and

- All other committees.

Shaun McCutcheon is an Alabama businessman who regularly makes political contributions to Republican candidates and the Republican National Committee. McCutcheon wanted to contribute $26,200 more to candidates and committees than the aggregate ceiling would allow. The Republican National Committee was also a plaintiff in the suit.

McCutcheon did not challenge the base limits on contributions to individual candidates and entities, but, wanting to give to more candidates and political entities than allowed by law, he challenged the aggregate limits.

Decision:

In a 5-4 decision, with the majority joined by Justice Thomas in a separate concurring opinion, the Court found aggregate limits do not further the permissible government interest in preventing quid pro quo corruption or the appearance of such corruption.

The majority opinion, written by Chief Justice Roberts and joined by Justices Scalia, Kennedy, and Alito, found the aggregate contribution limits do not further the only governmental interest accepted as legitimate in Buckley v Valeo. The 1976 decision by the U.S. Supreme Court found aggregate limits to be a permissible government regulation to curtail corruption or the appearance of corruption.

In McCutcheon, the Court stated, “Congress may not regulate contributions simply to reduce the amount of money in politics.”

The Court equated political contributions with “political campaign speech,” writing, “Money in politics may at times seem repugnant to some, but so too does much of what the First Amendment vigorously protects. If the First Amendment protects flag burning, funeral protests, and Nazi parades—despite the profound offense such spectacles cause—it surely protects political campaign speech despite popular opposition.”

Effect on other jurisdictions: (updated June 16, 2014)

The McCutcheon decision’s effects extend beyond the federal campaign finance laws.

At its May 14, 2014 meeting, the Connecticut State Elections Enforcement Commission announced it would no longer enforce the state’s aggregate contribution limit absent further direction from the General Assembly or a court of competent jurisdiction. The commission stressed, however, the base contribution limits would remain in full force and effect.

In a policy statement dated June 4, 2014, the Maine Commission on Government Ethics and Practices stated it would no longer enforce the yearly $25,000 aggregate contribution limit applicable to individuals and entities contained in Maine Revised Statutes section 1015(3), barring guidance from the legislature or a court. The policy statement noted the commission’s intention to study the issues and perhaps propose legislation during the next legislative session.

The Maryland State Board of Elections issued a guidance memo stating the board would no longer enforce a $10,000 aggregate limit on donors’ contributions to state candidates during a four-year election cycle, while stressing the $4,000 limit on personal contributions to any one candidate was still in place.

The Massachusetts Office of Campaign and Political Finance (OCPF) announced it will no longer enforce the state’s $12,500 aggregate limit on the amount an individual may contribute to all candidates, but will continue to enforce the $5,000 aggregate limit on contributions by individuals to party committees.

A provision in Minnesota’s campaign finance law known as the “special sources limit” will no longer be enforced as applied to individual large donors. U.S. District Judge Donovan Frank issued a preliminary injunction barring enforcement of the law with respect to individual large donors in response to a challenge by the Institute for Justice on First Amendment grounds. Under section 10A.27(11) of the Minnesota Statutes, the special sources limit prohibits a campaign from raising more than 20 percent of its total contributions from lobbyists, political committees, and large donors contributing more than one half of the individual contribution limit. Donovan issued the injunction in light of the precedent set by McCutcheon. The defendants have the opportunity to appeal to the 8th U.S. Circuit Court of Appeals. If they choose not to appeal, the case will proceed to a final ruling at the district court level.

The U.S. District Court for the Southern District of New York struck down a campaign finance law limiting contributions to super PACs. Sections 14-114(8) and 14-126 of the New York Election Law imposed an annual aggregate contribution limit of $150,000 per contributor. Plaintiff New York Progress and Protection PAC challenged the aggregate contribution limits on First Amendment grounds. Citing the precedent established in Citizens United and McCutcheon, the judge enjoined New York’s aggregate contribution limit as an unconstitutional ban on free speech. In its May 2014 meeting, the State Board of Elections determined the $150,000 yearly aggregate limit on political contributions from individuals can no longer be enforced in light of recent federal court decisions. New York campaign finance law imposes a similar aggregate limit of $5,000 on a corporation’s yearly contributions. The board made no ruling with regard to the corporate limit; however that limit is being challenged in federal court.

On April 3, 2014, the Puerto Rico Office of the Electoral Comptroller issued an informational newsletter in light of the U.S. Supreme Court ruling. While the Court referenced similar aggregate limits in other states and jurisdictions, it did not go so far as to declare them unconstitutional. Therefore, the office is not taking any immediate action with regard to the Puerto Rico aggregate campaign finance limits established in 2011. It will request an opinion from the Puerto Rico Secretary of Justice to determine how the Court’s decision relates to Puerto Rico law. The office will issue new informational bulletins as further developments arise.

On April 16, 2014, the Rhode Island Board of Elections voted to support the creation of legislation eliminating aggregate political contribution limits. The vote was in reaction to the McCutcheon decision. State law currently prohibits an individual from making contributions of more than $10,000 in the aggregate to more than one candidate, political action committee (PAC), or political party committee or to a combination of candidates, PACs, and political party committees within a calendar year.

In Vermont, Senate Bill 82 added an aggregate contribution limit of $40,000 per election cycle, which was to take effect January 1, 2015. However, the implementation of the aggregate contribution limit was contingent on the Supreme Court ruling in favor of aggregate limits in McCutcheon. Because the Supreme Court in fact ruled against aggregate limits, Vermont’s aggregate limit will not go into effect.

Wisconsin’s aggregate limits had already been challenged in Young v. Government Accountability Board. The parties in that case agreed to put the case on hold until the McCutcheon decision was issued. Following the ruling, the Government Accountability Board reached a settlement in which it agreed the aggregate contribution limits for individuals and PACs contributing to state candidates were no longer enforceable.

The Wyoming Joint Corporations, Appropriations, and Political Subdivisions Interim Committee ordered a draft bill to repeal the state’s aggregate contribution limits, which conflict with the U.S. Supreme Court’s ruling in McCutcheon.

In light of the ruling in McCutcheon, the Los Angeles Ethics Commission announced it would no longer enforce the aggregate limits on contributions to city and school board candidates. Limits on contributions to individual candidates remain in place.

The San Francisco Ethics Commission adopted a resolution stating it will not enforce the aggregate limit on contributions to city candidates in light of the McCutcheon ruling. The Campaign and Governmental Conduct Code imposes an aggregate limit of $500 multiplied by the number of city elective offices to be voted on in the election. The city’s $500 limit on contributions from an individual to a single city candidate remains in full force.

Analysis:

Quid pro quo corruption narrowly defined:

The Court maintained a narrow definition of quid pro quo corruption, preventing the government from limiting the First Amendment right to make contributions to as many candidates as an individual would like, within the base limits of contributions.

In the decision, the Court marked a solid delineation between corruption and appreciation: “[T]here is a clear, administrable line between money beyond the base limits funneled in an identifiable way to a candidate—for which the candidate feels obligated—and money within the base limits given widely to a candidate’s party—for which the candidate, like all other members of the party, feels grateful. . . . To recast such shared interest, standing alone, as an opportunity for quid pro quo corruption would dramatically expand government regulation of the political process.”

The Court found the possibility that an individual who spends large sums may garner “influence over or access to” elected officials or political parties does not give rise to such quid pro quo corruption.

The Court wrote, “The Government may no more restrict how many candidates or causes a donor may support than it may tell a newspaper how many candidates it may endorse.”

Arguing against the dissent’s argument that corruption could still occur even without the circumvention of the base contribution limits, the majority found such an argument would broaden the definition of quid pro quo corruption. The Court stated the dissent’s interpretation “dangerously broadens the . . . definition of quid pro quo corruption . . . and targets as corruption the general, broad-based support of a political party.”

Circumvention of base limits:

The Court found the argument that aggregate contributions could circumvent base contribution limits unconvincing.

The majority said the basis for allowing the law on aggregate limits to stand falls on “speculative” scenarios of corruption, which the Court found “highly implausible” and “hard to believe.” The Court said “experience and common sense” foreclose on many of the scenarios of schemes to funnel money, including one scenario the District Court found had merit. The Court found, “Based on what we can discern from experience, the indiscriminate ban on all contributions above the aggregate limits is disproportionate to the Government’s interest in preventing circumvention.”

The Court stressed that once an individual reaches the aggregate limit, the law denies “the individual all ability to exercise his expressive and associational rights by contributing to someone who will advocate for his policy preferences.”

Disclosure:

The Court also argued disclosure of contributions “minimizes the potential for abuse of the campaign finance system.”

The majority maintained lifting the aggregate limits encourages money away from entities not subject to disclosure: “Individuals can, for example, contribute unlimited amounts to 501(c) organizations, which are not required to publicly disclose their donors.”

Citing Citizens United, Justice Roberts wrote, “Disclosure requirements burden speech, but—unlike the aggregate limits—they do not impose a ceiling on speech.” In Citizens United, the Court held 8-1 that laws requiring the disclosure of political contribution were constitutional.

Legislative alternatives suggested by the Court:

The majority opinion suggested Congress could create other legislation to curtail circumvention of the base limits, such as enacting legislation targeting restrictions on transfers among candidates and political committees.

Additionally they wrote, “Congress might also consider a modified version of the aggregate limits, such as one that prohibits donors who have contributed the current maximum sums from further contributing to political committees that have indicated they will support candidates to whom the donor has already contributed.”

Overturning Buckley v Valeo’s holding on aggregate limits:

In overturning the 1976 U.S. Supreme Court Buckley v Valeo’s ruling on aggregate limits, the Court found the 38-year-old decision did not thoroughly address aggregate limits in its analysis. The Court also found subsequent laws enacted have “considerably strengthened” statutory safeguards against circumventing base limits through the transfer of contributions between parties and political committees. Additionally the Court argues Buckley did not address the “overbreadth challenge” with respect to the aggregate limits.

The Court rejected an alternative provided in the Supreme Court’s prior Buckley decision finding a person could personally volunteer for a candidate. The majority found “personal volunteering is not a realistic alternative for those who wish to support a wide variety of candidates or causes.”

The Court also heavily relied on campaign finance cases decided in the last few years, such as Citizens United v FEC and Arizona Free Enterprise Club’s Freedom Club PAC v Bennett.

Justice Thomas, in his separate opinion concurring with the majority ruling, writes Buckley “denigrates core First Amendment speech and should be overruled.”

Today, the Massachusetts Office of Campaign and Political Finance (OCPF) announced it will no longer enforce the state’s aggregate political contribution limit for the amount an individual may contribute to candidates. The law, G.L. §55-7A(a)(5), limits the aggregate amount an […]

Today, the Massachusetts Office of Campaign and Political Finance (OCPF) announced it will no longer enforce the state’s aggregate political contribution limit for the amount an individual may contribute to candidates.

The law, G.L. §55-7A(a)(5), limits the aggregate amount an individual can contribute to all candidates to $12,500. The OCPF made its decision based on today’s U.S. Supreme Court’s decision, McCutcheon vs. Federal Election Commission, which found aggregate limits on federal campaign contributions are an unconstitutional violation of the First Amendment’s guarantee of political expression and association.

However, the OCPF is going to review the decision more closely before deciding whether the $5,000 aggregate limit on contributions by individuals to party committees can remain standing. On its webpage, the OCPF stated, “The statutory provisions at the federal level that were analyzed by the Court in McCutcheon differ substantially from the law in Massachusetts, and a determination on the applicability of the ruling in this area will be made after careful review.”

April 2, 2014 •

Pennsylvania House Committee Bans Cash Gifts

The Pennsylvania House Bipartisan Management Committee has adopted an ethics rule banning cash gifts. The rule was imposed in response to the highly publicized sting operation involving four House members who allegedly took cash from a lobbyist. The rule permits […]

The Pennsylvania House Bipartisan Management Committee has adopted an ethics rule banning cash gifts.

The rule was imposed in response to the highly publicized sting operation involving four House members who allegedly took cash from a lobbyist.

The rule permits house members to receive cash from family members and non-lobbyist friends.

Photo of the Pennsylvania State Capitol courtesy of Michael180 on Wikimedia Commons.

April 2, 2014 •

Wisconsin Legislators Adjourn 2014 Regular Session

The state Senate adjourned the last general-business floorperiod of the 2014 regular session on April 1, 2014, after passing more than 50 bills. The Assembly previously adjourned early on March 21, 2014. Gov. Scott Walker has six business days to […]

The state Senate adjourned the last general-business floorperiod of the 2014 regular session on April 1, 2014, after passing more than 50 bills. The Assembly previously adjourned early on March 21, 2014.

Gov. Scott Walker has six business days to sign or veto legislation he receives. While the Legislature has no plans to return this year, Walker may call a special session to pass a bill requiring voters to show photo identification at the polls.

Photo of the Wisconsin State Capitol courtesy of Dori on Wikimedia Commons.

Today the United States Supreme Court ruled that aggregate limits on federal campaign contributions are unconstitutional. In a 5-4 decision, with a separate majority opinion by Justice Thomas, the Court found aggregate limits do not further the permissible government interest […]

Today the United States Supreme Court ruled that aggregate limits on federal campaign contributions are unconstitutional.

In a 5-4 decision, with a separate majority opinion by Justice Thomas, the Court found aggregate limits do not further the permissible government interest in preventing quid pro quo corruption or the appearance of such corruption.

The case, McCutcheon v. Federal Election Commission, sought to allow Shaun McCutcheon to make political contributions to several federal candidates exceeding the two-year aggregate limit set in 2 U.S.C §441a(a)(3)(A). The plaintiff had argued the limit is unconstitutional because it violates a citizen’s right to speak and to associate with not just any candidate, but every candidate of his choosing. The Supreme Court had decided to grant a review of the case in February 2013 and oral arguments were made on October 8, 2013.

Photo of the United State Supreme Court Building courtesy of Mfield on Wikimedia Commons.

April 2, 2014 •

California Senate Leaders Cancel Golf Following Suspensions

Democratic legislative leaders are reassessing campaign finance practices and have canceled a lucrative golf fundraiser scheduled for the weekend. Senate President Pro Tem Darrell Steinberg and Sen. Kevin de León announced plans to conduct a “vigorous review” of fundraising practices […]

Democratic legislative leaders are reassessing campaign finance practices and have canceled a lucrative golf fundraiser scheduled for the weekend. Senate President Pro Tem Darrell Steinberg and Sen. Kevin de León announced plans to conduct a “vigorous review” of fundraising practices and campaign finance laws following the suspension of Sen.

Leland Yee and two other senators involved in separate criminal investigations.

The senate leaders announced the cancellation of the Pro Tem Cup, an annual golf fundraiser at Torrey Pines in San Diego. Tickets were to benefit the state Democratic Party with a price range from $15,000 to $65,000 per person.

Photo of the California Senate Chamber courtesy of David Monniaux on Wikimedia Commons.

A bill introduced yesterday in the Louisiana House would require political committees, candidates, and other persons who file campaign disclosure reports to include a detailed explanation of the purpose of each expenditure. The explanation would be required to contain sufficient […]

A bill introduced yesterday in the Louisiana House would require political committees, candidates, and other persons who file campaign disclosure reports to include a detailed explanation of the purpose of each expenditure. The explanation would be required to contain sufficient information to relate the expenditure to an acceptable use.

According to the Times-Picayune, Reps. Tim Burn and Greg Miller, the sponsors of House Bill 1079, want “better, increased disclosure and less ambiguity about the political or campaign purpose of an expenditure.” If passed, the new reporting requirements would take effect on January 1, 2015.

April 1, 2014 •

Federal Court Enjoins Delaware Reporting Requirement

The United States District Court for the District of Delaware granted a preliminary injunction sought by Delaware Strong Families, who challenged a new Delaware campaign finance law requiring sponsors of third-party advertisements to disclose the identities of their donors. Specifically, […]

The United States District Court for the District of Delaware granted a preliminary injunction sought by Delaware Strong Families, who challenged a new Delaware campaign finance law requiring sponsors of third-party advertisements to disclose the identities of their donors.

Specifically, Section 8031 of the Delaware Election Disclosures Act, which became effective January 1, 2012, requires any person who makes an expenditure for a third-party advertisement exceeding $500 during an election period to file a report with the Elections Commission, including the names and addresses of each person who has made contributions to the sponsor of the third-party advertisements exceeding $100.

Delaware Strong Families alleged such donor disclosure requirement was overbroad and therefore unconstitutional. The District Court agreed and enjoined further enforcement of this reporting requirement, noting that the Act is so broadly worded as to include virtually every communication made during an election period, no matter how indirect and unrelated it is to the electoral process.

April 1, 2014 •

South Dakota Adjourns Legislative Session

The Legislature adjourned sine die on March 31, 2014, following the veto session. Gov. Dennis Daugaard vetoed only a measure to allow certain municipalities to charge a higher occupational tax. Legislators failed to override the veto on Senate Bill 98. […]

The Legislature adjourned sine die on March 31, 2014, following the veto session.

Gov. Dennis Daugaard vetoed only a measure to allow certain municipalities to charge a higher occupational tax.

Legislators failed to override the veto on Senate Bill 98.

March 31, 2014 •

See Us in Person!

Here is our April-May calendar. State and Federal Communications will be attending these events. If you plan to be there as well, be sure to say hello! April 6-9 Broadcast Education Association 2014 Convention, Las Vegas, Nevada April 7-8 […]

Here is our April-May calendar. State and Federal Communications will be attending these events. If you plan to be there as well, be sure to say hello!

Here is our April-May calendar. State and Federal Communications will be attending these events. If you plan to be there as well, be sure to say hello!

April 6-9 Broadcast Education Association 2014 Convention, Las Vegas, Nevada

April 7-8 PAC Spring Executive Meeting, Washington, D.C.

April 11 YouToo Social Media Conference, Kent, Ohio

April 9-11 SGAC Annual Meeting, San Francisco, California

April 30 – May 2 OSBA Convention, Columbus, Ohio

May 8 Women in Government Relations Spring Reception, Washington, D.C.

Q. I am currently a registered lobbyist who files reports on a monthly basis. I incurred a permissible meal expenditure on a covered official at the end of last month. However, I did not pay for the expenditure until I […]

Q. I am currently a registered lobbyist who files reports on a monthly basis. I incurred a permissible meal expenditure on a covered official at the end of last month. However, I did not pay for the expenditure until I received my credit card bill this month. What date should I use to report the expenditure?

A. A common question concerns what accounting method to use for the reporting of expenses. The accrual basis of accounting reports expenditures according to the time the benefit is given. The cash basis of accounting reports expenditures according to the time it is actually paid.

The exact accounting method used depends on the jurisdiction in question. Both Arizona and Michigan prefer the accrual method of accounting. An expenditure is reported when it occurs or is given, not when it is paid. Indiana provides for activity reports to be filed on a cash basis. South Carolina also follows this method requiring an expenditure to be reported at the time it is paid.

Some states do not have a set accounting method to be used when reporting expenditures or permit either method to be used. In California, an expenditure should be reported at the time the benefit is given; however, if it is reported when the money is paid, the actual date of the expenditure should be noted. Pennsylvania allows a registrant to use any reasonable methods of estimation and allocation. However, once a method of accounting is chosen, filers should be consistent in its use. The filer should also keep an internal record of the accounting method used in case there is an audit by the Pennsylvania Department of State. Texas law indicates an expenditure does not have to be reported until the amount is readily determinable. An expenditure made by a credit card may be reported either according to when the expenditure is made or when the bill is received.

After confirming an expenditure is permissible, you must include it on the proper report. Consult with your jurisdiction’s filing office to determine the accounting method used for the disclosure of expenditures.

![]()

You can directly submit questions for this feature, and we will select those most appropriate and answer them here. Send your questions to: experts@stateandfed.com.

(We are always available to answer questions from clients that are specific to your needs, and we encourage you to continue to call or e-mail us with questions about your particular company or organization. As always, we will confidentially and directly provide answers or information you need.) Our replies to your questions are not legal advice. Instead, these replies represent our analysis of laws, rules, and regulations.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.