October 13, 2022 •

Arizona Voters To Decide Original Donor Disclosure

Arizona State Flag

On November 8, Arizona voters will decide on a campaign finance ballot measure that would require disclosing names of original campaign donors. Proposition 211 would require that anyone making independent expenditures of more than $50,000 on a statewide campaign or […]

On November 8, Arizona voters will decide on a campaign finance ballot measure that would require disclosing names of original campaign donors.

Proposition 211 would require that anyone making independent expenditures of more than $50,000 on a statewide campaign or $25,000 on a local campaign to disclose the names of the money’s original sources, which would be defined as the persons or businesses that earned the money being spent.

Organizations that fail to disclose would face a fine equal to the amount contributed, or up to three times that amount.

Proposition 211 would apply to corporations, nonprofit groups and charities that currently are not required to disclose the names of the people who give money to political campaigns that the organization backs.

The proposition would pertain only to spending on political advertising and would be administered by The Citizens Clean Elections Commission.

August 5, 2021 •

Hawaii Senate Bill Passes Related to Electioneering Communications

State of Hawaii

A Senate bill in Hawaii passed affecting the reporting of electioneering communications. Senate Bill 404 provides persons, including corporations, making expenditures for electioneering communications in an aggregate amount of $1,000 instead of $2,000 during any calendar year must file reports […]

A Senate bill in Hawaii passed affecting the reporting of electioneering communications.

Senate Bill 404 provides persons, including corporations, making expenditures for electioneering communications in an aggregate amount of $1,000 instead of $2,000 during any calendar year must file reports within 24 hours of each disclosure date.

The bill also exempts communications that are actual expenditures of an organization from being considered electioneering communications and excludes candidate and candidate committees from the disclosure requirements.

The information is effective and applicable for the 2022 primary election.

February 4, 2021 •

Spotlight Act: US Senate Bill to Enhance Disclosure of Financial Political Activity Reintroduced

US Capitol - by Martin Falbisoner via Wikimedia Commons

On February 3, U.S. Senators Jon Tester and Ron Wyden reintroduced a bill to reverse a U.S. Treasury Department’s decision limiting IRS disclosure requirement of certain tax-exempt organizations engaging in political activities. Senate Bill 215, the Spotlight Act, requires non-profit […]

On February 3, U.S. Senators Jon Tester and Ron Wyden reintroduced a bill to reverse a U.S. Treasury Department’s decision limiting IRS disclosure requirement of certain tax-exempt organizations engaging in political activities.

Senate Bill 215, the Spotlight Act, requires non-profit organizations engaging in political activity, such as donating to candidates and purchasing political ads, provide the IRS with the names and basic information of donors who contribute more than $5,000.

The bill repeals an IRS revenue procedure exempting certain tax-exempt organizations that are not 501(c)(3) organizations from the requirement to report the names and addresses of substantial contributors (persons who contribute more than $5,000 per year) on information returns that are filed with the IRS. The proposed legislation requires tax-exempt organizations falling under sections 501(c)(4), 501(c)(5), and 501(c)(6) of the Internal Revenue Code (e.g., social welfare organizations, labor organizations, business leagues) to disclose the names and addresses of all substantial contributors on their returns. The bill also eliminates the authority of the IRS to provide exceptions to the disclosure requirements for tax-exempt organizations.

A version of the Spotlight Act was first introduced by the Senators in 2018

December 18, 2020 •

Quebec to Update Lobbyist Registry Disclosure Platform

The year 2021 will likely bring major changes to the Quebec Lobbyists Registry online lobbying activity disclosure platform. In the works since the summer of 2019, the updated web platform aims to replace the “technological obsolescence” of the current site […]

The year 2021 will likely bring major changes to the Quebec Lobbyists Registry online lobbying activity disclosure platform.

In the works since the summer of 2019, the updated web platform aims to replace the “technological obsolescence” of the current site with a modern system, to improve the user experience, and to be in line with Quebec’s 2019-2023 digital transformation strategy, according to Lobbyists Commissioner Jean-Francois Routhier.

“The modernization of the lobbyists registry is without a doubt one of the biggest projects of our institution since its creation in 2002,” Routhier stated in his December 2020 newsletter.

A user committee made up of lobbyists, public office holders, journalists, and citizens has been testing a model of the new website to validate its user-friendliness and processes.

The commissioner has emphasized that the new website’s intuitive design, simplified process for registration, and increased capacity of searching for relevant information, are of interest to both lobbyists and the public.

Routhier says the new platform will replace the current Lobbyists Registry platform at the end of 2021.

December 17, 2020 •

Court Upholds FPPC Regulations Involving Use of Public Money in Campaigns

Sacramento, CA Skyline - Basil D Soufi

In a recent case, a Superior Court Judge ruled in favor of the Fair Political Practices Commission (FPPC). The judge upheld its authority to require disclosure of public money by public entities during an election campaign. The FPPC faced a […]

In a recent case, a Superior Court Judge ruled in favor of the Fair Political Practices Commission (FPPC).

The judge upheld its authority to require disclosure of public money by public entities during an election campaign.

The FPPC faced a challenge from the California State Association of Counties and California School Boards Association of its regulations requiring government agencies spending taxpayer money to influence voters to disclose their activity in the same manner as other individuals, groups, and entities who spend money to influence voters.

In a ruling in Los Angeles Superior Court, the Honorable Judge Mitchell Beckloff ruled the regulations in question are legal and within the authority of the FPPC.

The ruling bolsters the FPPC’s determination these regulations are valid and enforceable.

December 15, 2020 •

Seattle City Council Votes to Require Registration and Disclosure by Public Lobbying Groups

Seattle City Hall - Rootology

City Council approved an ordinance requiring additional transparency and disclosures by paid lobbyists and indirect lobbying campaigns. The vote was 8-1. This new legislation adds the concept of indirect lobbying to the city’s lobbying regulations, which has been part of […]

City Council approved an ordinance requiring additional transparency and disclosures by paid lobbyists and indirect lobbying campaigns.

The vote was 8-1.

This new legislation adds the concept of indirect lobbying to the city’s lobbying regulations, which has been part of Washington state law since 1973.

Indirect lobbying requirements will now apply to lobbyists, those who hire them, or organizations taking out ads to influence members of the public, and encourage members of the public to lobby their elected officials on legislation.

Individuals behind a group will now be required to identify themselves, their contractors, and donors for contributions of $25 or more.

The group will also be required to describe its purpose and record spending in monthly reports.

If approved by the Mayor, the rules will become effective in 180 days.

August 24, 2020 •

Federal Appellate Court Upholds District Court’s Invalidation of FEC Disclosure Regulation

DC Court of Appeals - photo by AgnosticPreachersKid

On August 21, the federal D.C. Circuit Court of Appeals upheld a 2018 federal District Court ruling invalidating a federal campaign finance regulation limiting the disclosure requirements of organizations making independent expenditures. On August 3, 2018, a federal district court […]

On August 21, the federal D.C. Circuit Court of Appeals upheld a 2018 federal District Court ruling invalidating a federal campaign finance regulation limiting the disclosure requirements of organizations making independent expenditures.

On August 3, 2018, a federal district court had ruled a campaign finance disclosure regulation followed for decades by the Federal Election Commission (FEC) failed to uphold disclosure requirements required by a federal statute.

Chief Judge Beryl A. Howell of the United States District Court for The District of Columbia issued an order, in CREW v. FEC, vacating 11 C.F.R. §109.10(e)(1)(vi), but stayed the vacatur to give time for the FEC to issue interim regulations comporting with the statutory disclosure requirements of 52 U.S.C. §30104(c). The court also has allowed the FEC 30 days to change an earlier FEC dismissal to conform with the court’s ruling. The FEC has not yet replaced the rule.

The case originated because of independent expenditures made in a 2012 Ohio senate race by the non-political social-welfare nonprofit Crossroads Grassroots Policy Strategies (Crossroads GPS), an affiliate of the American Crossroads Super PAC. Crossroads GPS did not report donors when reporting its independent expenditures, while it acknowledged receiving contributions over $200, arguing the donors did not donate funds directly tied to any specific reported expenditure, as the FEC interpreted 11 C.F.R. §109.10(e)(1)(vi) to require.

Non-political committees making independent expenditures over $250 in a calendar year must comply with disclosure obligations closely analogous to those imposed on political committees.

The vacated regulation required the identification of each person who made a contribution in excess of $200 to the person filing a disclosure report, including for non-political 501(c)(4) non-profit entities making independent expenditures, if the contribution was made for the purpose of furthering the reported independent expenditure. The district court found the regulation, as construed and applied by the FEC, did not require the disclosure of donors, absent the donor’s express agreement that the funds be used for the specific expenditures reported to the FEC, even though the donor may otherwise support and in fact contribute for the purpose of funding those expenditures.

The district court had found the regulation impermissibly narrows the mandated disclosure in 52 U.S.C. §30104(c)(2)(C), which requires the identification of such donors contributing for the purpose of furthering the non-political committee’s own express advocacy for or against the election of a federal candidate, even when the donor has not expressly directed that the funds be used in the precise manner reported.

Sacramento, CA Skyline - Basil D Soufi

The Fair Political Practices Commission (FPPC) voted to require more transparency and disclosure of those who use limited liability companies (LLC’s) to make political contributions. Aditionally, they would require campaigns to list the name of the actual person who directed […]

The Fair Political Practices Commission (FPPC) voted to require more transparency and disclosure of those who use limited liability companies (LLC’s) to make political contributions.

Aditionally, they would require campaigns to list the name of the actual person who directed the LLC political spending.

The first new regulation requires LLC’s involved in raising and spending money for political activity to name the person making the decisions.

The second new regulation requires campaigns receiving donations from LLC’s to also list the name of the person responsible for the political activity.

A 2019 FPPC Enforcement Division examination of LLC’s found it was relatively easy to find information about the type of business, its address and an agent for service of process.

However, it was extremely difficult to find the identities of the people behind the LLC’s owners or the true source of the political expenditures.

United States Supreme Court Building

The U.S. Supreme Court on Monday declined to take up a case challenging a Montana disclosure law. Specifically, the law requires disclosure of spending for political ads within 60 days of an election. In August 2019, the 9th U.S Circuit […]

The U.S. Supreme Court on Monday declined to take up a case challenging a Montana disclosure law.

Specifically, the law requires disclosure of spending for political ads within 60 days of an election.

In August 2019, the 9th U.S Circuit Court of Appeals upheld Montana’s law requiring nonprofit groups running ads mentioning candidates, political parties or ballot issues in the 60 day window before an election to report any spending of $250 or more and disclose who funded their efforts.

This law is part of the state’s Disclosure Act, while the case was filed by the National Association of Gun Rights in 2016.

In their lawsuit, the group stated they were planning on sending mailers in Montana.

However, they would not report their donors or spending because it violated their constitutional rights of free speech.

September 21, 2016 •

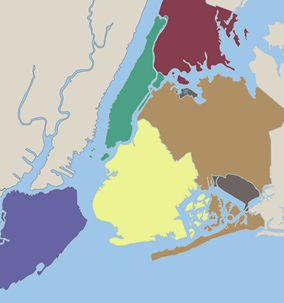

NYC Campaign Finance Board Launches Interactive Contributions Map

The New York City Campaign Finance Board has launched a new online tool to track individual contributions to participating 2017 candidates. The visualization of individual contributions is searchable by office, candidates, geography, and filing period. The interactive map may be […]

The New York City Campaign Finance Board has launched a new online tool to track individual contributions to participating 2017 candidates.

The New York City Campaign Finance Board has launched a new online tool to track individual contributions to participating 2017 candidates.

The visualization of individual contributions is searchable by office, candidates, geography, and filing period.

The interactive map may be found at http://maps.nyccfb.info/.

September 2, 2016 •

Ask the Experts!

Q. My company has registered lobbyists and is a member of local and regional associations in numerous states. Are there any unique disclosure requirements due to these circumstances? A. You should always consider a couple of different aspects of reporting with […]

Q. My company has registered lobbyists and is a member of local and regional associations in numerous states. Are there any unique disclosure requirements due to these circumstances?

Q. My company has registered lobbyists and is a member of local and regional associations in numerous states. Are there any unique disclosure requirements due to these circumstances?

A. You should always consider a couple of different aspects of reporting with this type of relationship. First and most obvious, the dues you pay to a trade association may have to be disclosed on your lobbying disclosure report. A trade association can engage in lobbying on behalf of its members, making a portion of your dues reportable as a lobbying expense.

Click here to read the full article

You must have a subscription to

www.stateandfed.com and be logged on!

Click here for subscription information

![]()

You can directly submit questions for this feature, and we will select those most appropriate and answer them here. Send your questions to: experts@stateandfed.com.

(We are always available to answer questions from clients that are specific to your needs, and we encourage you to continue to call or e-mail us with questions about your particular company or organization. As always, we will confidentially and directly provide answers or information you need.) Our replies to your questions are not legal advice. Instead, these replies represent our analysis of laws, rules, and regulations.

August 22, 2016 •

New York JCOPE Investigation Could Impact Lobbying Disclosure

The Joint Commission on Public Ethics (JCOPE) is investigating a series of donations to Manhattan nonprofit Pledge 2 Protect. Under current law, groups engaged in lobbying activities exceeding $50,000 annually must disclose donors of $5,000 or more. The investigation arose […]

The Joint Commission on Public Ethics (JCOPE) is investigating a series of donations to Manhattan nonprofit Pledge 2 Protect.

The Joint Commission on Public Ethics (JCOPE) is investigating a series of donations to Manhattan nonprofit Pledge 2 Protect.

Under current law, groups engaged in lobbying activities exceeding $50,000 annually must disclose donors of $5,000 or more. The investigation arose from a series of donations nearing $700,000 from unknown sources to a newly founded law firm, Marquart & Small. These donations were ultimately given to Pledge 2 Protect, with only Marquart & Small disclosed as Pledge 2 Protect’s donor.

Depending on the outcome of the case, Marquart & Small may be required to name their undisclosed third-party donors, and similarly situated groups would have to do the same moving forward.

June 30, 2016 •

New York Lobbying Groups May Face Increased Disclosure

Under Senate Bill 8160, charities donating to state lobbying nonprofits could be subject to new disclosure requirements. If signed into law, the bill would require any charitable organization donating over $2,500 to New York lobbying campaigns to disclose all of […]

Under Senate Bill 8160, charities donating to state lobbying nonprofits could be subject to new disclosure requirements.

Under Senate Bill 8160, charities donating to state lobbying nonprofits could be subject to new disclosure requirements.

If signed into law, the bill would require any charitable organization donating over $2,500 to New York lobbying campaigns to disclose all of its donors, including those unrelated to lobbying efforts. To determine the donation amount, in-kind donations of staff or other resources will be included, in addition to monetary donations. Public disclosure would then follow if the State Attorney General’s Office verifies no individual donor would be harmed by release of the information.

Gov. Andrew Cuomo is expected to sign the bill.

In an end-of-session bipartisan push, the Legislature and governor have come to agreement on ethics reform measures. Their five-point plan includes the following: With more disclosure measures in place, super PACs are now able to give and receive unlimited contributions […]

In an end-of-session bipartisan push, the Legislature and governor have come to agreement on ethics reform measures.

In an end-of-session bipartisan push, the Legislature and governor have come to agreement on ethics reform measures.

Their five-point plan includes the following:

- With more disclosure measures in place, super PACs are now able to give and receive unlimited contributions if they do not coordinate with a candidate;

- Public officers convicted of corruption may face revocation or reduction of their pensions;

- First-time political consultants will be required to disclose when they simultaneously represent political officeholders and private sector clients with government business;

- The reporting thresholds for organizations who lobby on their own behalf has been lowered from $50,000 to $15,000 while individual limits have been lowered from $5,000 to $2,500;

- Contributions over $2,500 to organizations engaged in lobbying must now also be reported to JCOPE; and

- 501(c)(4) organizations will now be required to disclose funding if they engage in political activity and receive any financial support and in-kind donations from 501(c)(3) organizations.

Other new features from the plan include imposition of fines up to $10,000 or the amount of promised contingency fees for anyone violating the state’s prohibition on contingency fee lobbying, a delineation excluding all communication with journalists from the definition of lobbying, and more due process rights for individuals being investigated by the Joint Commission of Public Ethics (JCOPE), including the right to a hearing.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.