November 9, 2022 •

New Pay-to-Play Takes Effect Today in DC

Today, a new pay-to-play law takes effect in the District of Columbia. Originally, the law was to go into effect on November 4, 2020, but was delayed due to the District choosing not to fund the implementation of the law […]

Today, a new pay-to-play law takes effect in the District of Columbia. Originally, the law was to go into effect on November 4, 2020, but was delayed due to the District choosing not to fund the implementation of the law until its 2022 budget.

Now, any business entity, or a principal of a business entity, seeking or holding a contract or multiple contracts with the district government is prohibited from making political contributions with an aggregate value of $250,000 or more to certain government officials. A principal of a business entity includes senior officers of that business entity, such as president, executive director, chief executive officer, chief operating officer, and chief financial officer. Government officials prohibited from receiving contributions from contractors can include, depending on the type of contract sought, the mayor and mayoral candidates, the attorney general and candidates for the position of attorney general, and councilmembers and councilmember candidates.

When seeking an exemption or abatement of a tax, contractors may have to disclose the estimated aggregate value of the exemption or abatement, if it is $250,000 or more, with a list of the contributions made.

A contractor violating pay-to-play restrictions may be considered to have breached the terms of any existing contract with the district. At the discretion of the contracting authority, any existing contract of the contractor may be terminated. The contractor may also be disqualified from eligibility for future District contracts, including the extension or modification of any existing contract, for a period of four calendar years after the date of determination that a violation has occurred.

November 9, 2022 •

Norton Reelected for Sixteenth Term as D.C. House Delegate

Eleanor Holmes Norton won reelection as the delegate to the U.S. House of Representatives from the District of Columbia. As a delegate, Norton’s seat in the House permits her the right of debate and all other privileges of U.S. representatives […]

Eleanor Holmes Norton won reelection as the delegate to the U.S. House of Representatives from the District of Columbia.

As a delegate, Norton’s seat in the House permits her the right of debate and all other privileges of U.S. representatives except for the ability to vote with the body.

Norton, a Democrat, will now serve a sixteenth consecutive term in office.

November 9, 2022 •

Ooltewah Reelected as Shadow Representative

Oye Ooltewah won reelection as the District of Columbia’s Shadow Representative. Unlike the District’s non-voting Delegate to the House, the Shadow Representative is not able to vote in both floor votes and committee votes and is not recognized as an […]

Oye Ooltewah won reelection as the District of Columbia’s Shadow Representative.

Unlike the District’s non-voting Delegate to the House, the Shadow Representative is not able to vote in both floor votes and committee votes and is not recognized as an actual member of the U.S. House of Representatives.

Along with Owolewa’s goal to achieve statehood for the District, the underlying goal of all shadow representatives, he has expressed an objective of ending federal taxes for the District until it achieves full political representation.

Ooltewah was first elected to the seat in 2020.

November 9, 2022 •

Bowser Reelected for Third Term as D.C. Mayor

On November 8, Mayor Muriel E. Bowser handily won reelection. Bower beat challengers Republican Stacia R. Hall, Libertarian Dennis Sobin, and Independent Rodney “Red” Grant. First elected as mayor in 2014, Browser, a Democrat, will now serve a third consecutive […]

On November 8, Mayor Muriel E. Bowser handily won reelection.

Bower beat challengers Republican Stacia R. Hall, Libertarian Dennis Sobin, and Independent Rodney “Red” Grant.

First elected as mayor in 2014, Browser, a Democrat, will now serve a third consecutive term in office.

November 7, 2022 •

Date for Mississauga–Lakeshore (Ontario) Federal By-Election Announced

On December 12, a federal by-election will be held for the electoral district of Mississauga–Lakeshore (Ontario) to fill a vacancy in the House of Commons. On May 30, the Chief Electoral Officer of Canada, Stéphane Perrault, received official notice from […]

On December 12, a federal by-election will be held for the electoral district of Mississauga–Lakeshore (Ontario) to fill a vacancy in the House of Commons.

On May 30, the Chief Electoral Officer of Canada, Stéphane Perrault, received official notice from the Speaker of the House of Commons that the seat for Mississauga–Lakeshore (Ontario) became vacant following the resignation of Sven Spengemann. Spengemann officially resigned from his seat in the House of Commons on May 28 in order to work for the United Nations.

The by-election date was announced on November 6. The Elections Canada office in Mississauga–Lakeshore will open soon, according to an Elections Canada press release.

October 3, 2022 •

U.S. Senate Passes Disclosing Foreign Influence in Lobbying Act

On September 29, the United States Senate passed the Disclosing Foreign Influence in Lobbying Act. The legislation, Senate Bill 4254, amends the Lobbying Disclosure Act of 1995 to require those registering as federal lobbyists include in their disclosures “the name […]

On September 29, the United States Senate passed the Disclosing Foreign Influence in Lobbying Act.

The legislation, Senate Bill 4254, amends the Lobbying Disclosure Act of 1995 to require those registering as federal lobbyists include in their disclosures “the name and address of each government of a foreign country (including any agency or subdivision of a foreign government, such as a regional or municipal unit of government) and foreign political party, other than the client, that participates in the direction, planning, supervision, or control of any lobbying activities of the registrant.”

The bill, which passed by unanimous consent, next moves to the U.S. House of Representatives.

September 20, 2022 •

Four-Year Strategy Plan Issued by Elections Nova Scotia

Nova Scotia flag

Although the next provincial election in Nova Scotia isn’t scheduled until 2025, Elections Nova Scotia (ENS) has published its strategic blueprint in preparation for that election and beyond. ENS’s new four-year strategic plan, which will last until 2026, focuses on […]

Although the next provincial election in Nova Scotia isn’t scheduled until 2025, Elections Nova Scotia (ENS) has published its strategic blueprint in preparation for that election and beyond. ENS’s new four-year strategic plan, which will last until 2026, focuses on five areas for improving electoral services.

The plan concentrates on how ENS will enhance the electoral process for all Nova Scotians through inclusion, diversity, equity, and access; how ENS will build relationships and partnerships with stakeholders; and how ENS will lead in the modernization of electoral services.

Additionally, the plan focuses on fostering a team culture that sets staff up for success and supporting election workers to excel in service delivery.

The plan was created by ENS’s Senior Leadership team.

August 2, 2022 •

Dara Lindenbaum Sworn In as New FEC Commissioner

FEC; Photo: Sarah Silbiger/CQ Roll Call

On August 2, Dara Lindenbaum was sworn in as a commissioner on the Federal Election Commission (FEC). FEC Vice Chair Steven T. Walther, whom Lindenbaum is replacing, retired from the commission on August 1. Lindenbaum, who was confirmed by the […]

On August 2, Dara Lindenbaum was sworn in as a commissioner on the Federal Election Commission (FEC).

FEC Vice Chair Steven T. Walther, whom Lindenbaum is replacing, retired from the commission on August 1.

Lindenbaum, who was confirmed by the U.S. Senate in May, has worked as an attorney with Sandler Reiff Lamb Rosenstein & Birkenstock, P.C., and with the Voting Rights Project at the Lawyers’ Committee for Civil Rights Under Law.

With the appointment of Lindenbaum, the FEC will consist of three registered members of the Republican Party, and three registered members of the Democratic Party. No more than three members of the FEC may be registered with the same political party.

July 18, 2022 •

Bipartisan Bill Introduced in U.S. Senate to Stop Federal Security Contractors’ Conflict of Interests

A bipartisan bill was introduced into the U.S. Senate aimed at increasing federal oversight to prevent national security consulting firms from contracting both with the United States and countries like Russia and China. Senate Bill 4516, Obstructive National Security Underreporting […]

A bipartisan bill was introduced into the U.S. Senate aimed at increasing federal oversight to prevent national security consulting firms from contracting both with the United States and countries like Russia and China.

Senate Bill 4516, Obstructive National Security Underreporting of Legitimate Threats (CONSULT), introduced by Republican U.S. Senator Joni Ernst and Democratic Senators Maggie Hassan and Gary Peters, would require consulting firms to disclose any potential organizational conflict of interest with certain entities, such as beneficial ownership, active contracts, contracts held within the last five years, and any other relevant information with foreign adversarial entities or governments. In turn, it would also allow for these conflicts of interest to be grounds for denial of a contract, or for the suspension and debarment of a contractor.

The bill, introduced on July 13, would also require the Federal Acquisition Regulatory Council to update federal acquisition regulations for implementation and calls for a government-wide policy to mitigate and eliminate organizational conflict of interests relating to national security.

According to Senator Hassan’s press release, “The CONSULT Act comes after reports surfaced that the consulting firm McKinsey & Company was providing strategic advice for state-owned companies in China and Russia while also being awarded national security contracts by the United States. These Chinese and Russian entities include a handful that have been blacklisted by federal agencies.”

June 30, 2022 •

Regional Municipality of Niagara’s Lobbying Law Penalties and Sanctions Come into Force in October

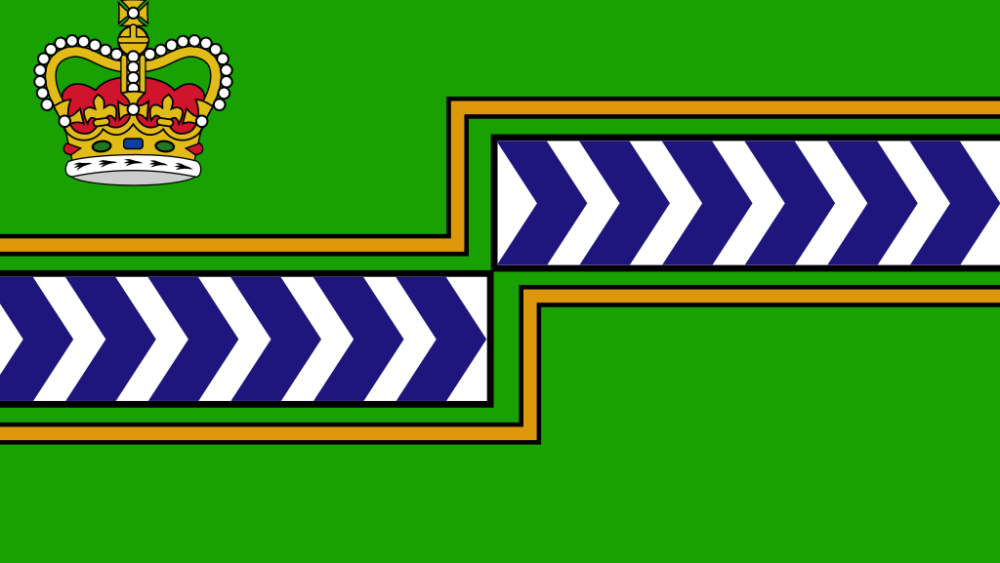

Flag of the Regional Municipality of Niagara

On October 14, 2022, penalties and sanctions for the Regional Municipality of Niagara’s new lobbying law come into force and effect. In the meantime, and although the Regional Council approved the Lobbyist Registry By-law 2022-24 to establish a Lobbyist Registry […]

On October 14, 2022, penalties and sanctions for the Regional Municipality of Niagara’s new lobbying law come into force and effect. In the meantime, and although the Regional Council approved the Lobbyist Registry By-law 2022-24 to establish a Lobbyist Registry on April 14, there is a six-month educational period where penalties and sanctions will not be applied.

The new law applies to lobbying public office holders, which it defines as members of the Regional Council, officers or employees of the Council, members of local boards and committees established by the Council, and any accountability officer, including the Integrity Commissioner, the Lobbyist Registrar, an Ombudsman, and Closed Meeting Investigators. The new legislation also applies when lobbying Individuals under contract with the Region who are providing consulting or other advisory services to the Region related to matters with budgetary or operational impacts during the term of their contract.

In the law, lobbying means any communication with a public office holder by an individual who is paid or who represents a business or financial interest with the goal of trying to influence any legislative action including development, introduction, passage, defeat, amendment or repeal of a by-law, motion, resolution or the outcome of a decision on any matter before the Council, a committee of Council, or a staff member acting under delegated authority.

Registration is required electronically within five days of lobbying occurring. Lobbyist must update their registrations by filing a return if there are any changes or additions to the registration. If Lobbying continues for more than one year, a lobbyist must file a new registration for each year the lobbying continues. There are three types of lobbyists requiring registration: consultant lobbyists, in-house lobbyists, and voluntary unpaid lobbyists who lobby without payment on behalf of an individual, business, or any for-profit entity for the benefit of the interests of the individual, business, or for-profit entity.

Lobbyists also have to abide by a Code of Conduct, which is part of the new law.

Submitting a bid proposal as part of the procurement process and any communication with designated employees of the Region as permitted in the procurement policies and procurement documents of the Region does not require registration as a lobbyist. Former public office holders are prohibited from engaging in lobbying activities for 12 months after leaving their position. Once enforcement of penalties begins in October, lobbyists can be prohibited from lobbying for different time periods. Criminal activity will be referred to appropriate authorities.

The Regional Municipality of Niagara, also colloquially known as the Niagara Region or Region of Niagara, is composed of 12 municipalities falling under its jurisdiction, including Niagara Falls.

A bipartisan bill aimed at fighting the influence of foreign actors was introduced into the U.S. House of Representatives. House Bill 8106, the Fighting Foreign Influence Act, was introduced by Democratic U.S. Representatives Jared Golden and Katie Porter together with […]

A bipartisan bill aimed at fighting the influence of foreign actors was introduced into the U.S. House of Representatives. House Bill 8106, the Fighting Foreign Influence Act, was introduced by Democratic U.S. Representatives Jared Golden and Katie Porter together with Republican U.S. Representative Paul Gosar.

The bill itself contains three separate Acts.

The Think Tank and Non-Profit Foreign Influence Disclosure Act would amend the Internal Revenue Code of 1986 to require tax exempt organizations, including think tanks, to disclose when a government of a foreign country or a foreign political party makes aggregate contributions and gifts of more than $50,000, which would then become publicly available in a searchable database.

The Congressional and Executive Foreign Lobbying Ban Act would amend The Foreign Agents Registration Act of 1938 to prohibit former members of Congress, senior political appointees, and general or flag officers of the armed forces from ever registering as the agent of a foreign principal.

The Stop Foreign Donations Affecting Our Elections Act would amend the Federal Election Campaign Act of 1971 to require political campaigns to verify that anyone making an online contribution has a valid address (using a credit card’s three-digit CVV code) before making a campaign contribution and prohibit foreign agents from fundraising for political campaigns.

The bill, introduced into the U.S. House on June 16, has been referred to the House Administration, the Ways and Means, and the Judiciary committees.

June 21, 2022 •

First Phase of Quebec’s Lobbyist Registry Begins

On June 21, Jean-François Routhier, the Commissioner of Lobbying with Lobbyisme Québec, officially deployed the first phase of Carrefour Lobby Quebec, the new online disclosure regime of lobbying activities for the province. The current registry of lobbyists will be replaced […]

On June 21, Jean-François Routhier, the Commissioner of Lobbying with Lobbyisme Québec, officially deployed the first phase of Carrefour Lobby Quebec, the new online disclosure regime of lobbying activities for the province.

The current registry of lobbyists will be replaced by Carrefour Lobby Québec, which will be administered by Lobbyisme Québec. The official and complete launch of Carrefour Lobby Québec is anticipated to take place in the fall of 2022. At that time, the current lobbyists’ registry will close.

Beginning June 21, the most senior executives of companies and organizations carrying out lobbying activities and their authorized representatives, as well as consultant lobbyists, will begin to be invited to proceed with the creation of their individual account and their businesses or organizations on the new website. Lobbyisme Québec plans to help support registered lobbyists efficiently transition to the new website during the second and final phase of the platform’s deployment.

According to the Office of Lobbyisme’s press release, the Lobbyists Commissioner has recommended that the government, as provided for in Bill 13, adopt the decree setting the entry into force of the new platform on October 13, 2022.

In the works since the summer of 2019, the updated web platform aims to replace the “technological obsolescence” of the current site with a modern system, to improve the user experience, and to be in line with Quebec’s 2019-2023 digital transformation strategy.

June 13, 2022 •

Caroline J. Simard Appointed Commissioner of Canada Elections

Flag of Canada

On August 15, Caroline J. Simard will begin her tenure as the new Commissioner of Canada Elections. The Commissioner of Canada Elections is responsible for ensuring compliance with, and enforcement of, the Canada Elections Act. The Chief Electoral Officer (CEO) […]

On August 15, Caroline J. Simard will begin her tenure as the new Commissioner of Canada Elections.

The Commissioner of Canada Elections is responsible for ensuring compliance with, and enforcement of, the Canada Elections Act. The Chief Electoral Officer (CEO) Mr. Stéphane Perrault announced the appointment of Simard on June 13. While the commissioner operates independently from Elections Canada in conducting investigations and other enforcement activities, the CEO appoints the commissioner after consultation with the Director of Public Prosecutions.

Caroline J. Simard has been Vice-Chairperson, Broadcasting, at the Canadian Radio-television and Telecommunications Commission since 2017.

Ms. Simard is replacing Yves Côté, who is finishing his 10-year term as Commissioner of Canada Elections.

June 7, 2022 •

By-Election to be Called for Vacant Mississauga–Lakeshore (Ontario) Seat in House of Commons of Canada

Sometime before November 26, 2022, a by-election will be announced for the seat in the House of Commons representing Mississauga–Lakeshore in the province of Ontario. On May 30, the Chief Electoral Officer of Canada, Stéphane Perrault, received official notice from […]

Sometime before November 26, 2022, a by-election will be announced for the seat in the House of Commons representing Mississauga–Lakeshore in the province of Ontario.

On May 30, the Chief Electoral Officer of Canada, Stéphane Perrault, received official notice from the Speaker of the House of Commons that the seat for Mississauga–Lakeshore (Ontario) became vacant following the resignation of Sven Spengemann. Spengemann officially resigned from his seat in the House of Commons on May 28 in order to work for the United Nations.

Under the law, the by-election date must be announced between June 10 and November 26, 2022, and will signal the start of the by-election period. According to Elections Canada, the earliest date the by-election can be held is July 18, 2022.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.