November 13, 2023 •

U.S. Supreme Court Announces a Code of Conduct for Itself

United States Supreme Court Building

On November 13, the United States Supreme Court issued its first Code of Conduct to regulate its own ethical behavior. In a statement from the Court, it said, “The absence of a Code . . . has led in recent […]

On November 13, the United States Supreme Court issued its first Code of Conduct to regulate its own ethical behavior.

In a statement from the Court, it said, “The absence of a Code . . . has led in recent years to the misunderstanding that the Justices of this Court, unlike all other jurists in this country, regard themselves as unrestricted by any ethics rules. To dispel this misunderstanding, we are issuing this Code, which largely represents a codification of principles that we have long regarded as governing our conduct.”

The code is broken into five canons of behavior and includes commentary of the canons.

The canons address upholding the integrity and independence of the judiciary; avoiding impropriety and the appearance of impropriety in all activities; performing the duties of office fairly, impartially, and diligently; engaging in extrajudicial activities that are consistent with the obligations of the judicial office; and refraining from political activity.

The code is substantially derived from the Code of Conduct for U.S. Judges but adapted for the Court.

To assist the Justices in complying with these Canons, the Chief Justice has directed Court officers to undertake an examination of best practices of other federal and state courts.

The Office of Legal Counsel plans on providing annual training to the Justices, staff, and Court personnel regarding recurring ethics and financial disclosure issues.

In addition to the Code of Conduct, Justices are directed to comply with various federal laws and rules, including the current Judicial Conference Regulations on gifts; foreign gifts and decorations; outside earned income, honoraria, and employment; and financial disclosure.

United States Supreme Court Building

On May 16, the U.S. Supreme Court struck down a part of federal campaign finance law regulating the repayment of loans from candidates to their own campaigns. Generally, Section 304 of the Bipartisan Campaign Reform Act of 2002 barred campaigns […]

On May 16, the U.S. Supreme Court struck down a part of federal campaign finance law regulating the repayment of loans from candidates to their own campaigns.

Generally, Section 304 of the Bipartisan Campaign Reform Act of 2002 barred campaigns from using more than $250,000 of political contributions raised after the election day to repay a candidate’s personal loans to their campaign committee.

In striking down the law, the majority opinion, written by Chief Justice Roberts and joined by five other Justices, concludes the law “increases the risk that candidate loans over $250,000 will not be repaid in full, inhibiting candidates from making such loans in the first place.”

The majority in FEC v. Ted Cruz for Senate, et al. concluded the law burdens core political speech without proper justification. The majority found the Federal Election Commission failed to demonstrate that the loan-repayment limit serves an interest in preventing quid pro quo corruption.

The dissenting opinion, written by Justice Kagan and joined by Justice Breyer and Justice Sotomayor, argued the burden of the law is minimal and the reasoning behind the enactment of the law remains valid: money given after an election to a candidate’s campaign committee, which will go directly to the candidate as repayment for their loan to the campaign committee, creates a heightened risk of corruption.

Senator Ted Cruz, the plaintiff in the case, loaned his campaign committee $260,000 one day before he was reelected. While the amount was $10,000 over the limit, the campaign committee had a 20-day grace period in which Cruz could have been fully repaid. It has been reported Cruz allowed the repayment to lapse beyond that date in order to establish a legal basis for bringing a challenge to the law.

February 25, 2022 •

Biden Nominated Judge Ketanji Brown Jackson to U.S. Supreme Court

Judge Ketanji Brown Jackson - by: Wikicago

On February 25, President Joe Biden nominated Judge Ketanji Brown Jackson to Serve as Associate Justice of the U.S. Supreme Court. Jackson will replace U.S. Supreme Court Justice Stephen G. Breyer, who is retiring from the bench upon confirmation of […]

On February 25, President Joe Biden nominated Judge Ketanji Brown Jackson to Serve as Associate Justice of the U.S. Supreme Court.

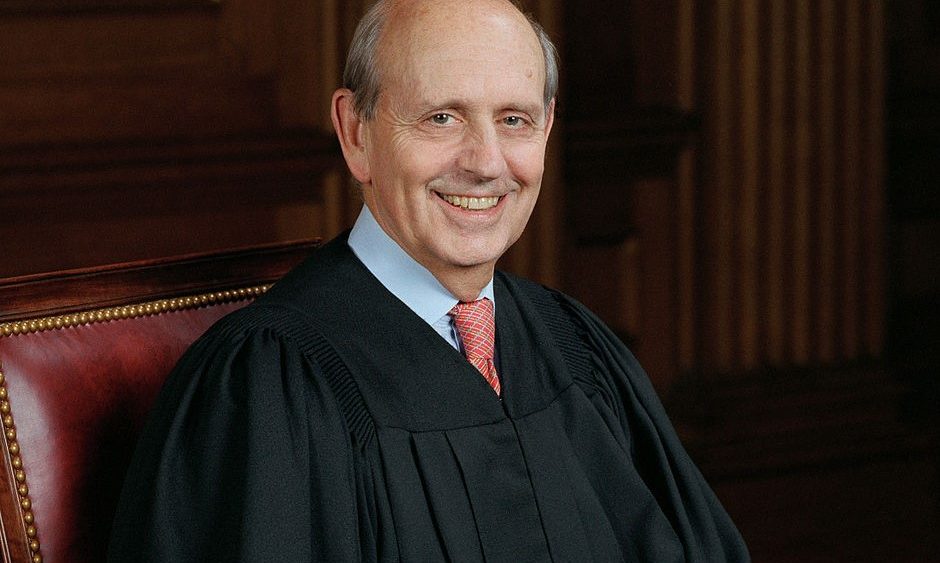

Jackson will replace U.S. Supreme Court Justice Stephen G. Breyer, who is retiring from the bench upon confirmation of his replacement. Breyer, at 83, is currently the oldest member of the Court, serving since 1994 when he was appointed by President Bill Clinton.

Jackson, who was once a clerk for Justice Breyer, is currently on the U.S. Court of Appeals for the D.C. Circuit. She has previously served as a federal district court judge, a member of the U.S. Sentencing Commission, an attorney in private practice, and as a federal public defender.

January 26, 2022 •

Breyer Retiring from U.S. Supreme Court

Justice Breyer - by: Collection of the Supreme Court of the United States, Photographer: Steve Petteway

U.S. Supreme Court Justice Stephen G. Breyer is retiring from the bench, according to the New York Times. The announcement is expected to formally be announced tomorrow, January 27, by President Joe Biden. Breyer, at 83, is currently the oldest […]

U.S. Supreme Court Justice Stephen G. Breyer is retiring from the bench, according to the New York Times.

The announcement is expected to formally be announced tomorrow, January 27, by President Joe Biden.

Breyer, at 83, is currently the oldest member of the Court, serving since 1994 when he was appointed by President Bill Clinton.

April 1, 2021 •

US Supreme Court: Facebook Did Not Violate TCPA

US Capitol - by Martin Falbisoner via Wikimedia Commons

On April 1, the United States Supreme Court unanimously decided automatic text messages sent to telephone numbers culled from a database of a sender, in this case from Facebook, and not from a system having the capacity either to store […]

On April 1, the United States Supreme Court unanimously decided automatic text messages sent to telephone numbers culled from a database of a sender, in this case from Facebook, and not from a system having the capacity either to store or to produce a telephone number using a random or sequential number generator, is not prohibited under The Telephone Consumer Protection Act of 1991 (TCPA).

While this decision does not apply to robocalls, it does seem to permit those in political campaigns to allow voice calls and text messages, taken from their databases, to be automatically made from technology not using a random or sequential number generator without fear of violating the TCPA.

In Facebook, Inc. v. Duguid, Noah Duguid, who had never created a Facebook account, continually received text messages from Facebook. Duguid alleged that Facebook violated the TCPA by maintaining a database storing phone numbers and sending automated text messages from that database. In a 9-0 decision, the court agreed with Facebook’s technical argument that the TCPA does not apply because the technology it used to text Duguid did not use a “random or sequential number generator.”

The TCPA was enacted to prevent the abuse of telemarketing made with an “automatic telephone dialing system” and other troublesome tactics.

April 3, 2020 •

Justices Decline Challenge to Seattle Democracy Vouchers

United States Supreme Court Building

The U.S. Supreme Court has declined to hear a challenge to Seattle’s first-in-the-nation democracy voucher program for public financing of political campaigns. The court denied the challenge brought by two local property owners arguing the program violated the First Amendment by forcing them, […]

The U.S. Supreme Court has declined to hear a challenge to Seattle’s first-in-the-nation democracy voucher program for public financing of political campaigns.

The court denied the challenge brought by two local property owners arguing the program violated the First Amendment by forcing them, through their tax dollars, to support candidates they don’t like.

In 2015, Seattle voters decided to tax themselves $3 million a year in order to receive four $25 vouchers they can donate to participating candidates in city elections.

The state Supreme Court unanimously upheld the voucher program last year.

May 20, 2019 •

Supreme Court Declines to Hear Corporate Contribution Case

United States Supreme Court Building

On Monday, the Supreme Court of the United States announced it would decline to hear a challenge to a Massachusetts law. The law in question bans corporate contributions to campaigns, parties and candidate-focused political action committees. The Massachusetts Supreme Judicial […]

On Monday, the Supreme Court of the United States announced it would decline to hear a challenge to a Massachusetts law.

The law in question bans corporate contributions to campaigns, parties and candidate-focused political action committees.

The Massachusetts Supreme Judicial Court unanimously rejected the challenge, brought by 1A Auto Inc. and 126 Self Storage Inc., in September.

The suit claimed disparate treatment by banning for-profit corporate contributions while allowing significant contributions by unions and nonprofits.

After the Supreme Court ruling in Citizens United, state law was updated to allow corporate spending for independent expenditures but not political contributions.

Massachusetts Attorney General Maura Healey applauded Monday’s decision not to hear the case for the integrity of state elections.

Opponents of the law are hopeful the Supreme Court will take up the issue in another case.

February 22, 2019 •

Supreme Court Won’t Hear Montana Case

This week, the Supreme Court of the United States declined to hear a case challenging the state’s Disclose Act, leaving in place a lower court ruling of constitutionality. The Disclose Act requires more heightened reporting by groups seeking to influence […]

This week, the Supreme Court of the United States declined to hear a case challenging the state’s Disclose Act, leaving in place a lower court ruling of constitutionality.

This week, the Supreme Court of the United States declined to hear a case challenging the state’s Disclose Act, leaving in place a lower court ruling of constitutionality.

The Disclose Act requires more heightened reporting by groups seeking to influence elections, commonly referred to as dark-money groups.

The campaign disclosure act, challenged by Montanans for Community Development on first amendment grounds, has been an important policy for Gov. Steve Bullock and his administration.

This comes at a time when the Montana House of Representatives is considering House Resolution 2, a bipartisan resolution urging Congress to propose a constitutional amendment to overturn the U.S. Supreme Court’s 2010 Citizens United decision.

January 15, 2019 •

U.S. Supreme Court Declines to Hear Montana Contribution Limit Case

The challenge on Montana’s contribution limits has ended. The U.S. Supreme Court did not take up the case regarding campaign finance in Montana. The 1994 law establishing the contribution limits was struck down in 2012 and 2015, but the 9th […]

The challenge on Montana’s contribution limits has ended. The U.S. Supreme Court did not take up the case regarding campaign finance in Montana.

The challenge on Montana’s contribution limits has ended. The U.S. Supreme Court did not take up the case regarding campaign finance in Montana.

The 1994 law establishing the contribution limits was struck down in 2012 and 2015, but the 9th U.S. Circuit Court of Appeals reinstated the limits in October 2017.

Proponents of the case said the low limits violated the First Amendment, while opponents said the limits encouraged more civil engagement.

June 6, 2017 •

Supreme Court Rules North Carolina Districts Racially Gerrymandered; Remedial Special Election Vacated

On June 5, the U.S. Supreme Court affirmed a lower court ruling that 28 state House and Senate Districts in North Carolina were racially gerrymandered, while also vacating the lower court’s order for a special election in 2017 for one-year […]

On June 5, the U.S. Supreme Court affirmed a lower court ruling that 28 state House and Senate Districts in North Carolina were racially gerrymandered, while also vacating the lower court’s order for a special election in 2017 for one-year terms to address the issue.

On June 5, the U.S. Supreme Court affirmed a lower court ruling that 28 state House and Senate Districts in North Carolina were racially gerrymandered, while also vacating the lower court’s order for a special election in 2017 for one-year terms to address the issue.

The court ruled that the special election remedy was not properly analyzed by the lower court. The matter has been returned to the lower court, which could call another special election or order new districts in time for the regular cycle of elections in 2018.

The Supreme Court’s decision comes just two weeks after the court found two of the state’s U.S. Congressional districts to also be racially gerrymandered.

On May 22, the United States Supreme Court affirmed a lower court’s finding of summary judgement upholding the constitutionality of the Federal Election Campaign Act’s regulation of the use of so-called soft money. In Republican Party of Louisiana v. FEC, […]

On May 22, the United States Supreme Court affirmed a lower court’s finding of summary judgement upholding the constitutionality of the Federal Election Campaign Act’s regulation of the use of so-called soft money.

On May 22, the United States Supreme Court affirmed a lower court’s finding of summary judgement upholding the constitutionality of the Federal Election Campaign Act’s regulation of the use of so-called soft money.

In Republican Party of Louisiana v. FEC, the United States District Court for the District of Columbia rejected a challenge to federal campaign finance provisions requiring state and local political parties to abide by federal regulations concerning certain political activities such as get-out-the-vote and voter registration drives and the resulting reporting requirements.

In response to an appeal from the plaintiffs, the Supreme Court affirmed the District Court’s decision.

July 7, 2016 •

Thursday News Roundup

Lobbying “Gov2Gov: The lobbying that falls under the radar” by Mike Maciag for Governing Rhode Island: “Raimondo: Lobbying law makes rules ‘clear, simple, consistent and transparent’” by Jennifer Bogdan for Providence Journal Campaign Finance Alabama: “Koch Brothers’ Plight Likened to […]

Lobbying

Lobbying

“Gov2Gov: The lobbying that falls under the radar” by Mike Maciag for Governing

Rhode Island: “Raimondo: Lobbying law makes rules ‘clear, simple, consistent and transparent’” by Jennifer Bogdan for Providence Journal

Campaign Finance

Alabama: “Koch Brothers’ Plight Likened to That of Civil Rights Workers in the 1950s” by John Dunbar for Center for Public Integrity

Arizona: “Possible Hack Shuts Down Online Portal to Public Campaign Financing” by Howard Fischer (Capitol Media Services) for East Valley Tribune

Minnesota: “Minnesota Campaign Watchdog Agency Director to Retire” by Rachel Stassen-Berger for St. Paul Pioneer Press

Ethics

“Is the Supreme Court Clueless About Corruption? Ask Jack Abramoff” by Carl Hulse for New York Times

Kentucky: “Lexington’s Ethics Act to Add Domestic Partners to Nepotism Ban” by Beth Musgrave for Lexington Herald-Leader

New York: “In Inquiry into Ex-Cuomo Aide, Disclosure Form Only Adds Mystery” by Vivian Yee for New York Times

South Carolina: “S.C. Ethics Commission Chief to Retire” by Avery Wilks for The State

Elections

“Nate Silver Is Happy to Be Wrong” by Glenn Thrush for Politico

June 14, 2016 •

CA Voters to Weigh In on ‘Citizens United’ Ballot Question

California’s Senate Bill 254 became law without the governor’s signature on June 9, 2016. The measure will place a ballot question on the November 8, 2016 ballot asking voters whether California’s elected officials should use all of their constitutional authority, […]

California’s Senate Bill 254 became law without the governor’s signature on June 9, 2016.

California’s Senate Bill 254 became law without the governor’s signature on June 9, 2016.

The measure will place a ballot question on the November 8, 2016 ballot asking voters whether California’s elected officials should use all of their constitutional authority, including proposing and ratifying one or more amendments to the United States Constitution, to overturn the Citizens United decision of the U.S. Supreme Court.

A previous version of this bill was approved by lawmakers in 2014, but was blocked by legal challenges until January 2016 when the Supreme Court of California upheld the Legislature’s power to use advisory ballot measures.

April 2, 2014 •

Analysis of U.S. Supreme Court McCutcheon Majority Decision: Aggregate Political Contributions Found Unconstitutional

Today, in McCutcheon v. Federal Election Commission (docket 12-536), the United States Supreme Court ruled aggregate limits on federal campaign contributions are an unconstitutional violation of the First Amendment’s guarantee of political expression and association. Background: Federal law imposes two […]

Today, in McCutcheon v. Federal Election Commission (docket 12-536), the United States Supreme Court ruled aggregate limits on federal campaign contributions are an unconstitutional violation of the First Amendment’s guarantee of political expression and association.

Background:

Federal law imposes two types of limits on individual political contributions.

Base limits restrict the amount an individual may contribute to:

- A candidate committee;

- A national party committee;

- A state, local, and district party committee; and

- A political action committee.

Biennial limits restrict the aggregate amount an individual may contribute biennially to:

- Candidate committees; and

- All other committees.

Shaun McCutcheon is an Alabama businessman who regularly makes political contributions to Republican candidates and the Republican National Committee. McCutcheon wanted to contribute $26,200 more to candidates and committees than the aggregate ceiling would allow. The Republican National Committee was also a plaintiff in the suit.

McCutcheon did not challenge the base limits on contributions to individual candidates and entities, but, wanting to give to more candidates and political entities than allowed by law, he challenged the aggregate limits.

Decision:

In a 5-4 decision, with the majority joined by Justice Thomas in a separate concurring opinion, the Court found aggregate limits do not further the permissible government interest in preventing quid pro quo corruption or the appearance of such corruption.

The majority opinion, written by Chief Justice Roberts and joined by Justices Scalia, Kennedy, and Alito, found the aggregate contribution limits do not further the only governmental interest accepted as legitimate in Buckley v Valeo. The 1976 decision by the U.S. Supreme Court found aggregate limits to be a permissible government regulation to curtail corruption or the appearance of corruption.

In McCutcheon, the Court stated, “Congress may not regulate contributions simply to reduce the amount of money in politics.”

The Court equated political contributions with “political campaign speech,” writing, “Money in politics may at times seem repugnant to some, but so too does much of what the First Amendment vigorously protects. If the First Amendment protects flag burning, funeral protests, and Nazi parades—despite the profound offense such spectacles cause—it surely protects political campaign speech despite popular opposition.”

Effect on other jurisdictions: (updated June 16, 2014)

The McCutcheon decision’s effects extend beyond the federal campaign finance laws.

At its May 14, 2014 meeting, the Connecticut State Elections Enforcement Commission announced it would no longer enforce the state’s aggregate contribution limit absent further direction from the General Assembly or a court of competent jurisdiction. The commission stressed, however, the base contribution limits would remain in full force and effect.

In a policy statement dated June 4, 2014, the Maine Commission on Government Ethics and Practices stated it would no longer enforce the yearly $25,000 aggregate contribution limit applicable to individuals and entities contained in Maine Revised Statutes section 1015(3), barring guidance from the legislature or a court. The policy statement noted the commission’s intention to study the issues and perhaps propose legislation during the next legislative session.

The Maryland State Board of Elections issued a guidance memo stating the board would no longer enforce a $10,000 aggregate limit on donors’ contributions to state candidates during a four-year election cycle, while stressing the $4,000 limit on personal contributions to any one candidate was still in place.

The Massachusetts Office of Campaign and Political Finance (OCPF) announced it will no longer enforce the state’s $12,500 aggregate limit on the amount an individual may contribute to all candidates, but will continue to enforce the $5,000 aggregate limit on contributions by individuals to party committees.

A provision in Minnesota’s campaign finance law known as the “special sources limit” will no longer be enforced as applied to individual large donors. U.S. District Judge Donovan Frank issued a preliminary injunction barring enforcement of the law with respect to individual large donors in response to a challenge by the Institute for Justice on First Amendment grounds. Under section 10A.27(11) of the Minnesota Statutes, the special sources limit prohibits a campaign from raising more than 20 percent of its total contributions from lobbyists, political committees, and large donors contributing more than one half of the individual contribution limit. Donovan issued the injunction in light of the precedent set by McCutcheon. The defendants have the opportunity to appeal to the 8th U.S. Circuit Court of Appeals. If they choose not to appeal, the case will proceed to a final ruling at the district court level.

The U.S. District Court for the Southern District of New York struck down a campaign finance law limiting contributions to super PACs. Sections 14-114(8) and 14-126 of the New York Election Law imposed an annual aggregate contribution limit of $150,000 per contributor. Plaintiff New York Progress and Protection PAC challenged the aggregate contribution limits on First Amendment grounds. Citing the precedent established in Citizens United and McCutcheon, the judge enjoined New York’s aggregate contribution limit as an unconstitutional ban on free speech. In its May 2014 meeting, the State Board of Elections determined the $150,000 yearly aggregate limit on political contributions from individuals can no longer be enforced in light of recent federal court decisions. New York campaign finance law imposes a similar aggregate limit of $5,000 on a corporation’s yearly contributions. The board made no ruling with regard to the corporate limit; however that limit is being challenged in federal court.

On April 3, 2014, the Puerto Rico Office of the Electoral Comptroller issued an informational newsletter in light of the U.S. Supreme Court ruling. While the Court referenced similar aggregate limits in other states and jurisdictions, it did not go so far as to declare them unconstitutional. Therefore, the office is not taking any immediate action with regard to the Puerto Rico aggregate campaign finance limits established in 2011. It will request an opinion from the Puerto Rico Secretary of Justice to determine how the Court’s decision relates to Puerto Rico law. The office will issue new informational bulletins as further developments arise.

On April 16, 2014, the Rhode Island Board of Elections voted to support the creation of legislation eliminating aggregate political contribution limits. The vote was in reaction to the McCutcheon decision. State law currently prohibits an individual from making contributions of more than $10,000 in the aggregate to more than one candidate, political action committee (PAC), or political party committee or to a combination of candidates, PACs, and political party committees within a calendar year.

In Vermont, Senate Bill 82 added an aggregate contribution limit of $40,000 per election cycle, which was to take effect January 1, 2015. However, the implementation of the aggregate contribution limit was contingent on the Supreme Court ruling in favor of aggregate limits in McCutcheon. Because the Supreme Court in fact ruled against aggregate limits, Vermont’s aggregate limit will not go into effect.

Wisconsin’s aggregate limits had already been challenged in Young v. Government Accountability Board. The parties in that case agreed to put the case on hold until the McCutcheon decision was issued. Following the ruling, the Government Accountability Board reached a settlement in which it agreed the aggregate contribution limits for individuals and PACs contributing to state candidates were no longer enforceable.

The Wyoming Joint Corporations, Appropriations, and Political Subdivisions Interim Committee ordered a draft bill to repeal the state’s aggregate contribution limits, which conflict with the U.S. Supreme Court’s ruling in McCutcheon.

In light of the ruling in McCutcheon, the Los Angeles Ethics Commission announced it would no longer enforce the aggregate limits on contributions to city and school board candidates. Limits on contributions to individual candidates remain in place.

The San Francisco Ethics Commission adopted a resolution stating it will not enforce the aggregate limit on contributions to city candidates in light of the McCutcheon ruling. The Campaign and Governmental Conduct Code imposes an aggregate limit of $500 multiplied by the number of city elective offices to be voted on in the election. The city’s $500 limit on contributions from an individual to a single city candidate remains in full force.

Analysis:

Quid pro quo corruption narrowly defined:

The Court maintained a narrow definition of quid pro quo corruption, preventing the government from limiting the First Amendment right to make contributions to as many candidates as an individual would like, within the base limits of contributions.

In the decision, the Court marked a solid delineation between corruption and appreciation: “[T]here is a clear, administrable line between money beyond the base limits funneled in an identifiable way to a candidate—for which the candidate feels obligated—and money within the base limits given widely to a candidate’s party—for which the candidate, like all other members of the party, feels grateful. . . . To recast such shared interest, standing alone, as an opportunity for quid pro quo corruption would dramatically expand government regulation of the political process.”

The Court found the possibility that an individual who spends large sums may garner “influence over or access to” elected officials or political parties does not give rise to such quid pro quo corruption.

The Court wrote, “The Government may no more restrict how many candidates or causes a donor may support than it may tell a newspaper how many candidates it may endorse.”

Arguing against the dissent’s argument that corruption could still occur even without the circumvention of the base contribution limits, the majority found such an argument would broaden the definition of quid pro quo corruption. The Court stated the dissent’s interpretation “dangerously broadens the . . . definition of quid pro quo corruption . . . and targets as corruption the general, broad-based support of a political party.”

Circumvention of base limits:

The Court found the argument that aggregate contributions could circumvent base contribution limits unconvincing.

The majority said the basis for allowing the law on aggregate limits to stand falls on “speculative” scenarios of corruption, which the Court found “highly implausible” and “hard to believe.” The Court said “experience and common sense” foreclose on many of the scenarios of schemes to funnel money, including one scenario the District Court found had merit. The Court found, “Based on what we can discern from experience, the indiscriminate ban on all contributions above the aggregate limits is disproportionate to the Government’s interest in preventing circumvention.”

The Court stressed that once an individual reaches the aggregate limit, the law denies “the individual all ability to exercise his expressive and associational rights by contributing to someone who will advocate for his policy preferences.”

Disclosure:

The Court also argued disclosure of contributions “minimizes the potential for abuse of the campaign finance system.”

The majority maintained lifting the aggregate limits encourages money away from entities not subject to disclosure: “Individuals can, for example, contribute unlimited amounts to 501(c) organizations, which are not required to publicly disclose their donors.”

Citing Citizens United, Justice Roberts wrote, “Disclosure requirements burden speech, but—unlike the aggregate limits—they do not impose a ceiling on speech.” In Citizens United, the Court held 8-1 that laws requiring the disclosure of political contribution were constitutional.

Legislative alternatives suggested by the Court:

The majority opinion suggested Congress could create other legislation to curtail circumvention of the base limits, such as enacting legislation targeting restrictions on transfers among candidates and political committees.

Additionally they wrote, “Congress might also consider a modified version of the aggregate limits, such as one that prohibits donors who have contributed the current maximum sums from further contributing to political committees that have indicated they will support candidates to whom the donor has already contributed.”

Overturning Buckley v Valeo’s holding on aggregate limits:

In overturning the 1976 U.S. Supreme Court Buckley v Valeo’s ruling on aggregate limits, the Court found the 38-year-old decision did not thoroughly address aggregate limits in its analysis. The Court also found subsequent laws enacted have “considerably strengthened” statutory safeguards against circumventing base limits through the transfer of contributions between parties and political committees. Additionally the Court argues Buckley did not address the “overbreadth challenge” with respect to the aggregate limits.

The Court rejected an alternative provided in the Supreme Court’s prior Buckley decision finding a person could personally volunteer for a candidate. The majority found “personal volunteering is not a realistic alternative for those who wish to support a wide variety of candidates or causes.”

The Court also heavily relied on campaign finance cases decided in the last few years, such as Citizens United v FEC and Arizona Free Enterprise Club’s Freedom Club PAC v Bennett.

Justice Thomas, in his separate opinion concurring with the majority ruling, writes Buckley “denigrates core First Amendment speech and should be overruled.”

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.