January 5, 2021 •

New Contributions Limits for North Carolina Candidates

The North Carolina State Board of Elections has announced an increase in the limits on contributions made to candidates. The limit will increase from $5,400 to $5,600 due to the 2.8% rise in the consumer price index from 2018 to […]

The North Carolina State Board of Elections has announced an increase in the limits on contributions made to candidates.

The limit will increase from $5,400 to $5,600 due to the 2.8% rise in the consumer price index from 2018 to 2020.

This increase is effective from January 1, 2021, through December 31, 2022.

September 3, 2020 •

Fort Collins City Council Approves New Campaign Finance Amendments

Fort Collins City Council approved several campaign finance changes on September 1 that will take effect in time for the April 2021 city election. The amendments include limits to how much individuals can contribute to limited liability corporations and political […]

Fort Collins City Council approved several campaign finance changes on September 1 that will take effect in time for the April 2021 city election.

The amendments include limits to how much individuals can contribute to limited liability corporations and political committees to support or oppose city races.

City Council voted 5-2 on the political committee and LLC contribution changes. This included votes in opposition from Mayor Wade Troxell and council member Ken Summers. In addition, council unanimously approved several other election code changes. The changes will apply to municipal elections for council seats, the mayoral race, and city ballot measures.

Current code allows LLCs to donate up to $75 to a candidate committee for a City Council member, or $100 to a committee for a mayoral candidate, which is the same limit for an individual. Because one person can be a member of multiple LLCs, people could bypass individual donation limits. This bypass could be accomplished by donating through various LLCs. Election finance records show this has happened in previous Fort Collins elections.

The amendment will bring this requirement into alignment with the state election code. The current code requires donations from LLCs to include statements that attribute the donation to specific LLC members. The donations attributed through an LLC will then count toward individual donation limits.

The political committee amendment will place a $100 cap on donations to political committees. There is currently no limit on contributions to political committees. This occurs when two or more people who come together to accept contributions or make expenditures to support or oppose one or more candidates.

The amendments will be presented for final passage on September 15.

On May 28, new Internal Revenue Service (IRS) regulations allowing certain tax-exempt organizations to refrain from reporting the names and addresses of contributors on their annual reports to the IRS will take effect and be published in the U.S. Federal […]

On May 28, new Internal Revenue Service (IRS) regulations allowing certain tax-exempt organizations to refrain from reporting the names and addresses of contributors on their annual reports to the IRS will take effect and be published in the U.S. Federal Register.

This exemption from reporting applies to tax-exempt organizations generally not receiving tax-deductible contributions, such as labor unions, volunteer fire departments, issue-advocacy groups, local chambers of commerce, veterans’ groups, and community service clubs. These organizations are still required to continue to collect and keep the donor information and to make it available to the IRS upon its request. This change does not affect the information required to be reported by charities primarily receiving tax-deductible contributions, such as 501(c)(3) organizations, certain nonexempt private foundations, or 527 political organizations.

The Treasury Department and IRS had given three primary reasons for the change: the IRS makes no systematic use of this information collected by these organizations; the policy reduces the risk of inadvertent disclosure or misuse of confidential information; and the policy saves both private and government resources.

Previously, the IRS had issued a guidance to this effect, but on July 30, 2019, the IRS guidance limiting these disclosure requirements was set aside by a federal judge. In Bullock v. IRS, the U.S. District Court District of Montana (Great Falls) found the IRS violated the Administrative Procedure Act by not providing notice and allowing a public comment period before the guidance was issued. It predicated this decision by finding the guidance was a legislative rule. Subsequently, on September 6, the IRS issued a notice of a proposed rulemaking and accepted public comment.

September 10, 2019 •

FPPC Proposes Sponsored Committee Amendments

On October 18, the Fair Political Practices Commission (FPPC) will consider proposed amendments adding language to help determine when a committee reaches the 80% threshold for qualification as a sponsored committee. The threshold will be determined by all contributions received […]

On October 18, the Fair Political Practices Commission (FPPC) will consider proposed amendments adding language to help determine when a committee reaches the 80% threshold for qualification as a sponsored committee.

The threshold will be determined by all contributions received by a committee in the preceding 24 months.

A committee will also be required to determine if it qualifies as a sponsored committee, or if a sponsor changed, at the time of filing each campaign statement.

The proposed amendments would also provide additional guidance regarding the appropriate terms which should be used to describe the industry or group affiliation of multiple sponsors.

The FPPC is accepting written comments on the proposals until October 16, 2019.

September 21, 2016 •

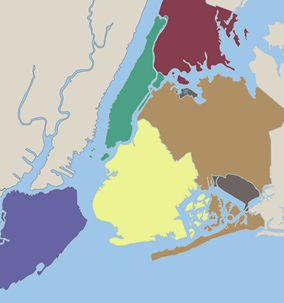

NYC Campaign Finance Board Launches Interactive Contributions Map

The New York City Campaign Finance Board has launched a new online tool to track individual contributions to participating 2017 candidates. The visualization of individual contributions is searchable by office, candidates, geography, and filing period. The interactive map may be […]

The New York City Campaign Finance Board has launched a new online tool to track individual contributions to participating 2017 candidates.

The New York City Campaign Finance Board has launched a new online tool to track individual contributions to participating 2017 candidates.

The visualization of individual contributions is searchable by office, candidates, geography, and filing period.

The interactive map may be found at http://maps.nyccfb.info/.

April 28, 2015 •

Maryland Governor Announces Bills to be Signed, Cancels Ceremony

Gov. Larry Hogan canceled the bill-signing ceremony scheduled for April 28, 2015, in response to rioting in Baltimore. Prior to the cancellation, Hogan released a list of over 180 bills he intends to sign, including a bill to change contribution […]

Gov. Larry Hogan canceled the bill-signing ceremony scheduled for April 28, 2015, in response to rioting in Baltimore. Prior to the cancellation, Hogan released a list of over 180 bills he intends to sign, including a bill to change contribution disclosure reporting for lobbyist employers.

Gov. Larry Hogan canceled the bill-signing ceremony scheduled for April 28, 2015, in response to rioting in Baltimore. Prior to the cancellation, Hogan released a list of over 180 bills he intends to sign, including a bill to change contribution disclosure reporting for lobbyist employers.

Senate Bill 767 modifies the threshold amount to include contributions in the aggregate amount of $500 or more, in order to match disclosure requirements of persons doing public business. The bill also changes semi-annual reporting dates to May 31 and November 30.

Since the bill goes into effect June 1, 2015, this year’s dates have been modified to August 31 and November 30. Previously, reports were due on February 5 and August 5.

House Bill 769, a bill making similar changes to contribution disclosure requirements for persons doing public business, is not listed as a bill to be signed. The final bill signing is currently scheduled for May 12, 2015.

Photo of Gov. Larry Hogan by Marrh2 on Wikimedia Commons.

March 21, 2014 •

Wisconsin Assembly Passes Lobbyist Contribution Bill

The Assembly has passed a bill to widen the ability of lobbyists to provide campaign contributions. Senate Bill 655 allows a lobbyist to deliver or personally make political contributions as early as April 15 of a general election year, the […]

The Assembly has passed a bill to widen the ability of lobbyists to provide campaign contributions.

Senate Bill 655 allows a lobbyist to deliver or personally make political contributions as early as April 15 of a general election year, the same day candidates can circulate petitions for office.

Currently, lobbyists must wait until June 1 to make contributions. The bill now goes to Gov. Scott Walker.

September 15, 2010 •

72 Hours from Donation to Broadcast

Nevada Transparency Measures to be Introduced in 2011.

Assembly Majority Leader John Oceguera said he will pursue a number of transparency measures in the 2011 legislative session. Among those to be introduced would be a requirement for all candidates for public office to report every financial contribution online within 72 hours of receipt, including the amount received and the donor.

Assembly Majority Leader John Oceguera said he will pursue a number of transparency measures in the 2011 legislative session. Among those to be introduced would be a requirement for all candidates for public office to report every financial contribution online within 72 hours of receipt, including the amount received and the donor.

Another measure would introduce a “cooling off” period before public officials could work as lobbyists. Specifically, an elected official or regulator would be prohibited from lobbying the governmental body where the individual served, or any agency they regulated or oversaw, for a period of two years.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.