August 25, 2016 •

Governor Signs New York Ethics Reform Bill

Today, Gov. Andrew Cuomo signed Senate Bill 8160, part of his five-point ethics reform package introduced earlier this year. Effective immediately, individuals working in public relations are no longer required to register or report as lobbyists. Other major changes to […]

Today, Gov. Andrew Cuomo signed Senate Bill 8160, part of his five-point ethics reform package introduced earlier this year. Effective immediately, individuals working in public relations are no longer required to register or report as lobbyists.

Today, Gov. Andrew Cuomo signed Senate Bill 8160, part of his five-point ethics reform package introduced earlier this year. Effective immediately, individuals working in public relations are no longer required to register or report as lobbyists.

Other major changes to lobbying law will take effect 30 days from today. The most important of these changes are: lobbyists and lobbyist employers will face lower reporting thresholds, and 501(c)(4) organizations engaged in lobbying activity will be required to disclose all donors, including 501(c)(3) organizations.

In the realm of campaign finance, the new reform provides definitions and permissible actions for two types of political committees and increased disclosure from PACs.

August 22, 2016 •

New York JCOPE Investigation Could Impact Lobbying Disclosure

The Joint Commission on Public Ethics (JCOPE) is investigating a series of donations to Manhattan nonprofit Pledge 2 Protect. Under current law, groups engaged in lobbying activities exceeding $50,000 annually must disclose donors of $5,000 or more. The investigation arose […]

The Joint Commission on Public Ethics (JCOPE) is investigating a series of donations to Manhattan nonprofit Pledge 2 Protect.

The Joint Commission on Public Ethics (JCOPE) is investigating a series of donations to Manhattan nonprofit Pledge 2 Protect.

Under current law, groups engaged in lobbying activities exceeding $50,000 annually must disclose donors of $5,000 or more. The investigation arose from a series of donations nearing $700,000 from unknown sources to a newly founded law firm, Marquart & Small. These donations were ultimately given to Pledge 2 Protect, with only Marquart & Small disclosed as Pledge 2 Protect’s donor.

Depending on the outcome of the case, Marquart & Small may be required to name their undisclosed third-party donors, and similarly situated groups would have to do the same moving forward.

August 11, 2016 •

JCOPE Extends Lobbyist Amnesty Program

The New York Joint Commission on Public Ethics has extended the deadline for the lobbyist amnesty program through September 30. The program is meant to encourage nonfiling lobbyists and employers to comply with the Lobbying Act by disclosing activity, as […]

The New York Joint Commission on Public Ethics has extended the deadline for the lobbyist amnesty program through September 30. The program is meant to encourage nonfiling lobbyists and employers to comply with the Lobbying Act by disclosing activity, as required by law.

The New York Joint Commission on Public Ethics has extended the deadline for the lobbyist amnesty program through September 30. The program is meant to encourage nonfiling lobbyists and employers to comply with the Lobbying Act by disclosing activity, as required by law.

The program remains open only to those who have never been contacted by JCOPE for noncompliance with filing requirements and have never been the subject of a criminal proceeding for a Lobbying Act violation. The parallel New York City program was not extended.

August 9, 2016 •

JCOPE Passes Regulations in Anticipation of Senate Bill 8160

JCOPE unanimously passed “emergency” regulations in anticipation of Gov. Andrew Cuomo signing Senate Bill 8160. Under Senate Bill 8160, any charitable organization donating over $2,500 to New York lobbying campaigns would be required to disclose all of its donors, including […]

JCOPE unanimously passed “emergency” regulations in anticipation of Gov. Andrew Cuomo signing Senate Bill 8160. Under Senate Bill 8160, any charitable organization donating over $2,500 to New York lobbying campaigns would be required to disclose all of its donors, including those unrelated to lobbying efforts.

JCOPE unanimously passed “emergency” regulations in anticipation of Gov. Andrew Cuomo signing Senate Bill 8160. Under Senate Bill 8160, any charitable organization donating over $2,500 to New York lobbying campaigns would be required to disclose all of its donors, including those unrelated to lobbying efforts.

JCOPE’s new regulations mostly mirror Senate Bill 8160, as any issue-oriented lobbying groups expending more than $15,000 a year would be required to disclose donors of more than $2,500.

The regulations become effective, if and when, Cuomo signs Senate Bill 8160. If Senate Bill 8160 is signed into law, the new reporting thresholds will retroactively include donations and lobbying spending beginning July 1, 2016.

August 2, 2016 •

Jurisdiction Added to our Website

The number of municipalities and regional governments our research associates track continues to grow. We now cover almost 300 municipalities and local governments. This is part of a continuous effort to better serve the needs of our clients. In that […]

The number of municipalities and regional governments our research associates track continues to grow. We now cover almost 300 municipalities and local governments. This is part of a continuous effort to better serve the needs of our clients.

The number of municipalities and regional governments our research associates track continues to grow. We now cover almost 300 municipalities and local governments. This is part of a continuous effort to better serve the needs of our clients.

In that effort, we have added abridged jurisdictions to our website. These entries, condensed due to the limited number of relevant local laws, provide the core information our clients need for their government relations work.

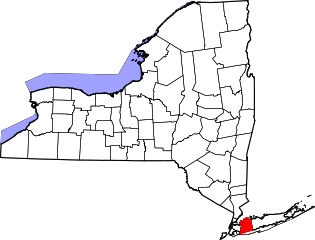

The new jurisdiction is: Nassau County, New York

July 22, 2016 •

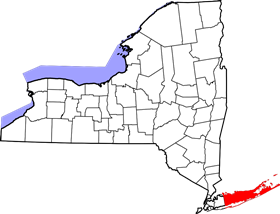

Suffolk County, NY Committee Delays Campaign Finance Measure from November Ballot Appearance

A legislative committee has voted against a proposed bill to finance Suffolk County candidates’ campaigns with future casino revenues and to increase term limits from two to four years. Specifics of the bill include a 4-to-1 match for donations up […]

A legislative committee has voted against a proposed bill to finance Suffolk County candidates’ campaigns with future casino revenues and to increase term limits from two to four years. Specifics of the bill include a 4-to-1 match for donations up to $150 for all candidates who agree to a $1,000 cap on contributions.

A legislative committee has voted against a proposed bill to finance Suffolk County candidates’ campaigns with future casino revenues and to increase term limits from two to four years. Specifics of the bill include a 4-to-1 match for donations up to $150 for all candidates who agree to a $1,000 cap on contributions.

As a result of the vote, the bill will not appear on the November ballot, but an initiative to allow a video slot machine casino in the Village of Islandia will.

The campaign finance bill’s sponsor, Legislator Rob Calarco, has indicated he would reintroduce his legislation if voters approve the casino initiative.

July 21, 2016 •

New York Bill Proposes Giving Limits

Sen. Todd Kaminsky and Representative Charles Lavine have introduced a new bill which would amend the penal law relating to unlawful giving. Senate Bill 8169 would close a loophole allowing public officials to receive or give gifts or benefits in […]

Sen. Todd Kaminsky and Representative Charles Lavine have introduced a new bill which would amend the penal law relating to unlawful giving. Senate Bill 8169 would close a loophole allowing public officials to receive or give gifts or benefits in excess of $3,000 simply because of their official position.

Sen. Todd Kaminsky and Representative Charles Lavine have introduced a new bill which would amend the penal law relating to unlawful giving. Senate Bill 8169 would close a loophole allowing public officials to receive or give gifts or benefits in excess of $3,000 simply because of their official position.

The bill does not affect campaign contributions, which are already monitored by the Board of Elections.

The legislation is a response to the recent Supreme Court decision in McDonnell v. The United States, which permits officials to receive lavish gifts so long as the gifts are not exchanged for promises to perform governmental acts.

June 30, 2016 •

New York Lobbying Groups May Face Increased Disclosure

Under Senate Bill 8160, charities donating to state lobbying nonprofits could be subject to new disclosure requirements. If signed into law, the bill would require any charitable organization donating over $2,500 to New York lobbying campaigns to disclose all of […]

Under Senate Bill 8160, charities donating to state lobbying nonprofits could be subject to new disclosure requirements.

Under Senate Bill 8160, charities donating to state lobbying nonprofits could be subject to new disclosure requirements.

If signed into law, the bill would require any charitable organization donating over $2,500 to New York lobbying campaigns to disclose all of its donors, including those unrelated to lobbying efforts. To determine the donation amount, in-kind donations of staff or other resources will be included, in addition to monetary donations. Public disclosure would then follow if the State Attorney General’s Office verifies no individual donor would be harmed by release of the information.

Gov. Andrew Cuomo is expected to sign the bill.

June 30, 2016 •

Albany County, NY Ethics Commission Names New Chair

During their first fully-staffed meeting in nearly five years, the county Ethics Commission named Shari Calnero as chair. Moving forward, the commission will offer guidance on potential conflicts of interest, financial disclosure requirements, and whether public officials will be required […]

During their first fully-staffed meeting in nearly five years, the county Ethics Commission named Shari Calnero as chair.

During their first fully-staffed meeting in nearly five years, the county Ethics Commission named Shari Calnero as chair.

Moving forward, the commission will offer guidance on potential conflicts of interest, financial disclosure requirements, and whether public officials will be required to recuse themselves from certain votes. The commission will meet at least once annually, and whenever called upon.

In an end-of-session bipartisan push, the Legislature and governor have come to agreement on ethics reform measures. Their five-point plan includes the following: With more disclosure measures in place, super PACs are now able to give and receive unlimited contributions […]

In an end-of-session bipartisan push, the Legislature and governor have come to agreement on ethics reform measures.

In an end-of-session bipartisan push, the Legislature and governor have come to agreement on ethics reform measures.

Their five-point plan includes the following:

- With more disclosure measures in place, super PACs are now able to give and receive unlimited contributions if they do not coordinate with a candidate;

- Public officers convicted of corruption may face revocation or reduction of their pensions;

- First-time political consultants will be required to disclose when they simultaneously represent political officeholders and private sector clients with government business;

- The reporting thresholds for organizations who lobby on their own behalf has been lowered from $50,000 to $15,000 while individual limits have been lowered from $5,000 to $2,500;

- Contributions over $2,500 to organizations engaged in lobbying must now also be reported to JCOPE; and

- 501(c)(4) organizations will now be required to disclose funding if they engage in political activity and receive any financial support and in-kind donations from 501(c)(3) organizations.

Other new features from the plan include imposition of fines up to $10,000 or the amount of promised contingency fees for anyone violating the state’s prohibition on contingency fee lobbying, a delineation excluding all communication with journalists from the definition of lobbying, and more due process rights for individuals being investigated by the Joint Commission of Public Ethics (JCOPE), including the right to a hearing.

June 20, 2016 •

New York Assembly Adjourns Sine Die

The Assembly adjourned early on Saturday, June 18, two days later than scheduled. In light of corruption convictions for former Speaker Sheldon Silver and Senate Majority Leader Dean Skelos, ethics reform was a primary focus of this term. The Legislature […]

The Assembly adjourned early on Saturday, June 18, two days later than scheduled.

In light of corruption convictions for former Speaker Sheldon Silver and Senate Majority Leader Dean Skelos, ethics reform was a primary focus of this term. The Legislature came to agreement on a five-point reform plan, including Assembly Bill 10739, which allows courts to reduce or revoke pensions for lawmakers convicted of felony-level corruption charges related to their responsibilities as public officials.

The bill is a constitutional amendment, so lawmakers will have to hold another vote at the beginning of the next regular session before voters will decide whether or not to accept the measure.

June 17, 2016 •

New York Legislature Returns to Review Ethics Reform Initiative

The Legislature was scheduled to adjourn Thursday, but will instead return Friday in an effort to reach final agreement on a few key bills. Assembly Bill 10739 has been sent to the Senate for review. If it is successful there, […]

The Legislature was scheduled to adjourn Thursday, but will instead return Friday in an effort to reach final agreement on a few key bills.

Assembly Bill 10739 has been sent to the Senate for review. If it is successful there, the bill would allow courts to revoke or reduce lawmakers’ pensions and retirement rights if they are convicted of felony-level corruption offenses.

Although a slew of other ethics reform bills was introduced during this session, no others are currently expected to pass.

June 17, 2016 •

New York Lawmakers Call for Overturn of Citizens United

A bipartisan majority of lawmakers is calling for an amendment to the U.S. Constitution overturning the Supreme Court’s 2010 decision in Citizens United v. Federal Election Commission. In the Citizens United decision, the Court ruled corporations and unions should be […]

A bipartisan majority of lawmakers is calling for an amendment to the U.S. Constitution overturning the Supreme Court’s 2010 decision in Citizens United v. Federal Election Commission.

A bipartisan majority of lawmakers is calling for an amendment to the U.S. Constitution overturning the Supreme Court’s 2010 decision in Citizens United v. Federal Election Commission.

In the Citizens United decision, the Court ruled corporations and unions should be considered individuals for purposes of political contributions; therefore, restricting their donations to candidates is a violation of their First Amendment right to free speech.

New York is now one of 16 states—and the first with a Republican-controlled chamber—supporting an amendment in response to the decision.

June 9, 2016 •

New York Governor Pushes for PAC Reforms

Gov. Andrew Cuomo has outlined another bill to supplement his ethics reform agenda. If passed, the new bill would create regulations and restrictions for independent expenditure campaigns and improve transparency, with the ultimate goal of preventing candidates from having direct […]

Gov. Andrew Cuomo has outlined another bill to supplement his ethics reform agenda.

Gov. Andrew Cuomo has outlined another bill to supplement his ethics reform agenda.

If passed, the new bill would create regulations and restrictions for independent expenditure campaigns and improve transparency, with the ultimate goal of preventing candidates from having direct control over Super PACs by selecting friends or political allies to steer them.

The new bill is an effort to coax the Legislature to pass ethical reforms before their session comes to a close next week.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.