August 6, 2019 •

Ohio Budget Bill Removes Tax Exemption for Attorneys and Lobbyists

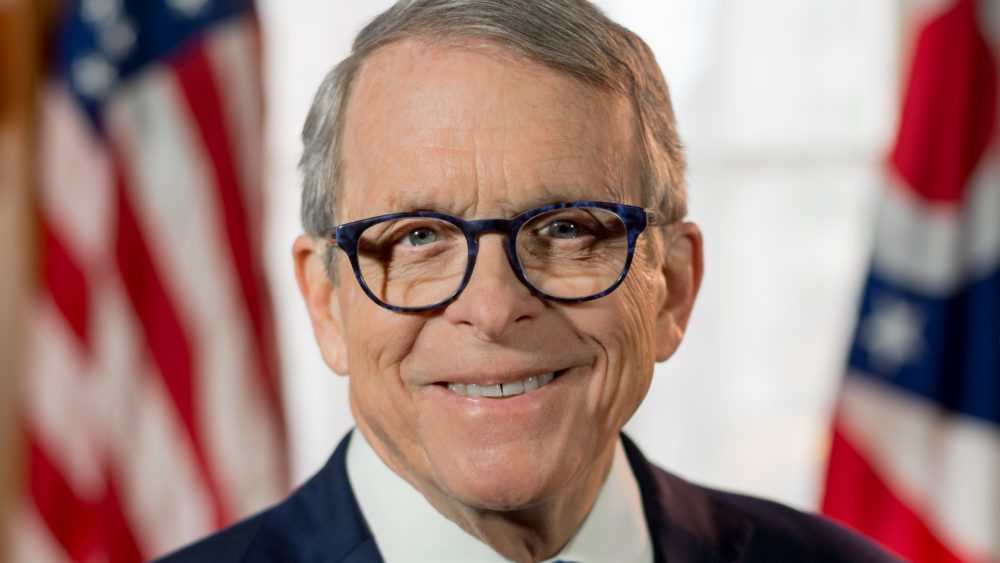

Ohio Gov. Mike DeWine

The state budget bill signed by Gov. DeWine includes a provision removing a tax exemption for attorneys and lobbyists beginning in 2020. Since 2013, the state business income deduction (BID) has allowed those deriving income from any pass-through entity (e.g., […]

The state budget bill signed by Gov. DeWine includes a provision removing a tax exemption for attorneys and lobbyists beginning in 2020.

Since 2013, the state business income deduction (BID) has allowed those deriving income from any pass-through entity (e.g., LLCs, LLPs) to pay no tax on the first $250,000 of income and a flat 3% on any income above the threshold.

House Bill 166 excludes otherwise eligible income from legal services provided by an attorney or income from legislative, executive agency, or retirement system lobbying activity.

A professional coalition including the Ohio State Bar Association (OSBA) is beginning a grassroots campaign to reverse the exclusion.

March 31, 2014 •

See Us in Person!

Here is our April-May calendar. State and Federal Communications will be attending these events. If you plan to be there as well, be sure to say hello! April 6-9 Broadcast Education Association 2014 Convention, Las Vegas, Nevada April 7-8 […]

Here is our April-May calendar. State and Federal Communications will be attending these events. If you plan to be there as well, be sure to say hello!

Here is our April-May calendar. State and Federal Communications will be attending these events. If you plan to be there as well, be sure to say hello!

April 6-9 Broadcast Education Association 2014 Convention, Las Vegas, Nevada

April 7-8 PAC Spring Executive Meeting, Washington, D.C.

April 11 YouToo Social Media Conference, Kent, Ohio

April 9-11 SGAC Annual Meeting, San Francisco, California

April 30 – May 2 OSBA Convention, Columbus, Ohio

May 8 Women in Government Relations Spring Reception, Washington, D.C.

State and Federal Communications, Inc. provides research and consulting services for government relations professionals on lobbying laws, procurement lobbying laws, political contribution laws in the United States and Canada. Learn more by visiting stateandfed.com.